Alia Bhatt

| Use attributes for filter ! | |

| Gender | Female |

|---|---|

| Age | 32 |

| Web site | twitter.com |

| Date of birth | March 15,1993 |

| Zodiac sign | Pisces |

| Born | Mumbai |

| India | |

| Height | 155 (cm) |

| Parents | Mahesh Bhatt |

| Soni Razdan | |

| Upcoming movies | Brahmastra |

| Kalank | |

| 2017 | |

| Job | Actor |

| Model | |

| Singer | |

| Fashion Designer | |

| Official site | instagram.com |

| Upcoming movie | RRR |

| Brahmāstra | |

| Rocky Aur Rani Ki Prem Kahani | |

| Heart of Stone | |

| Siblings | Pooja Bhatt |

| Shaheen Bhatt | |

| Rahul Bhatt | |

| Listen artist | www.youtube.com |

| Songs | 2020 |

| Current partner | Ranbir Kapoor |

| List | ShukriyaSadak 2 · 2020 |

| Tum Se HiSadak 2 · 2020 | |

| Dil Ki Purani SadakSadak 2 · 2020 | |

| 2020 | |

| Spouse | Ranbir Kapoor |

| Nationality | British |

| English | |

| Indian | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 424284 |

Raazi

Student of the Year

2 States

Badrinath Ki Dulhania

Dear Zindagi

Shaandaar

Humpty Sharma Ki Dulhania

Highway

Udta Punjab

Kapoor & Sons

Ugly

Sangharsh

Ae Dil Hai Mushkil

Kalank

Shuddhi

Apna Sapna Money Money

Andaz Naya Naya

The Anupam Kher Show - Kucch Bhi Ho Sakta Hai

Aaj Ki Raat Hai Zindagi

Gangubai Kathiawadi

RRR

Brahmāstra

Brahmāstra: Part One – Shiva

IIFA Award for Best Actress

IIFA Award for Style Icon of the Year

Filmfare Critics Award for Best Actress

Zee Cine Award for Best Actress

Screen Award for Best Actress

BIG Star Most Entertaining On-Screen Couple

Stardust Award for Superstar of Tomorrow – Female

Zee Cine Critics Award for Best Actor – Female

BIG Star Most Entertaining Dancer

Star Plus Entertainer of the Year

Star Plus Ki Nai Soch Award

Guild Award for Gionee Most Stylish Youth Icon

Life OK Screen Hero Award

BIG Star Most Entertaining Actor in a Romantic Role - Female

Alia Bhatt Life story

Alia Bhatt is a British actress of Indian descent who predominantly works in Hindi films. Known for her portrayals of women in troubling circumstances, she has received several accolades including five Filmfare Awards.

Starbucks: What a coffee ad reveals about transphobia in India

... Shubhika Sharma, founder of fashion label Papa Don t Preach - whose outfits have been worn by global stars like Alia Bhatt and Paris Hilton - recently launched a jewellery collection in collaboration with activist and poet, Alok Vaid-Menon, to spotlight their (Alok Menon uses the pronouns they/them) message of inclusivity and acceptance...

Asian Network turns 20: 'A safe space for British Asians'

... It has provided a platform for young British Asian music talents, while welcoming big-name guests such as Shah Rukh Khan, Alia Bhatt, Ranbir Kapoor and Deepika Padukone...

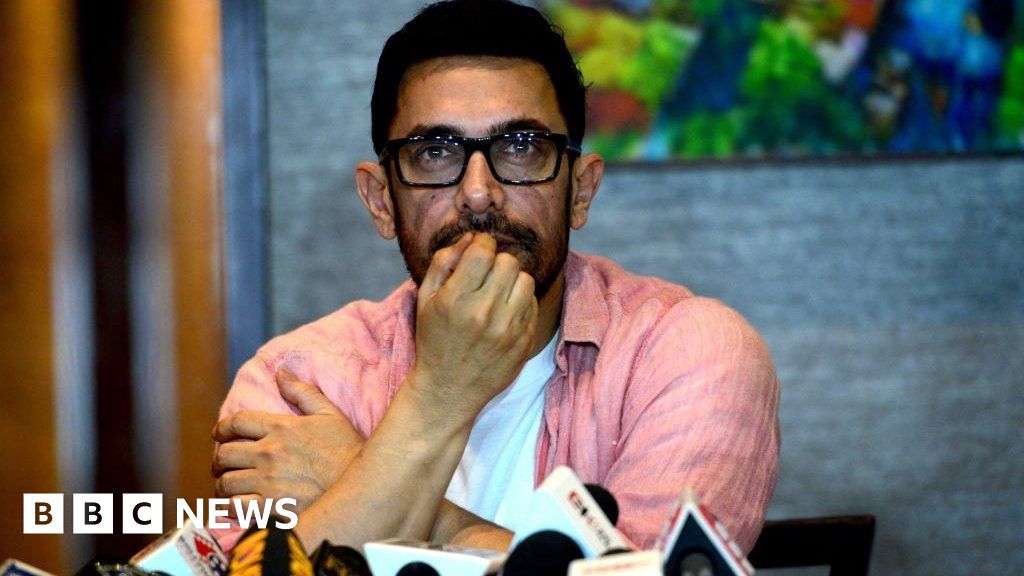

Aamir Khan: Minister asks Bollywood star to avoid ‘anti-Hindu' ads

... In 2021, actor Alia Bhatt faced criticism for featuring in an ad that questioned the practice of kanyadaan (giving away the bride) at Hindu weddings...

Start-ups fuel India's growing obsession with skincare

... Products mentioned in Bollywood actor Alia Bhatt s 2021 video on her skincare routine - a niacinamide serum, a watermelon-based moisturiser, caffeine skin drops - wouldn t have had an affordable equivalent in India five years ago...

Ranbir Kapoor and Alia Bhatt: Bollywood wishes star couple on wedding

...Bollywood stars Ranbir Kapoor and Alia Bhatt are set to tie the knot in what is being dubbed as one of the biggest weddings of the Indian film industry...

Bollywood: Coronavirus brings India's mega Film industry to a standstill

... Others, like Alia Bhatt and Hrithik Roshan, to learn new skills...

Start-ups fuel India's growing obsession with skincare

The Indian skincare market, the fifth largest in The World , has Seen a boom in recent years. Experts say it's driven by a large, young demographic willing to spend money to look good, as well as start-ups that have stepped in to leverage this.

" I've used all these sunscreens on my sensitive, oily, acne-prone skin. Ask me anything, " reads a popular post on r/IndianSkincareAddicts, a Reddit group formed in 2018, which now has nearly 45,000 members.

The accompanying photo features 18 different sunscreen bottles from Indian, Western and Korean brands.

Below it is a rigorous discussion on each product's consistency, texture, sweat and water resistance. A Far Cry from 10 Years ago, when sunscreens barely registered in The Indian consumer's mind despite the country's hot summers.

The skincare market in India has been dominated by legacy brands from companies such as Hindustan Unilever , Himalaya Wellness, Emami and Nivea for decades.

Western brands such as L'Oréal arrived in the 1990s after The Indian economy opened itself up to foreign players.

But the creams and cleansers on offer had little to distinguish themselves from each other besides price, packaging and Ayurvedic roots (or lack thereof).

The recent success of beauty start-ups offering homegrown skincare lines has disrupted The Market .

From $5. 8bn (£4. 6bn) in 2013, The Indian skincare market is projected to grow to $7. 65bn (£6bn) this year and add another $2bn (£1. 59bn) by 2026, according to, a Market Research company.

" The primary reason for this sudden boost is ease of accessibility of brands and products through channels like direct-to-consumer and ecommerce, along with express deliveries, " says Varun Alagh , co-founder and CEO of Honasa, which houses several skincare brands.

The effect is visible.

Products mentioned in Bollywood actor Alia Bhatt 's 2021 video on her skincare routine - a niacinamide serum, a watermelon-based moisturiser, caffeine skin drops - wouldn't have had an affordable equivalent in India five years ago.

Now they are a click away.

The skincare revolution

E-commerce platform Nykaa pioneered this change when it launched in 2012 by making a wide range of beauty and skincare products accessible on its website.

At The Time , skincare and personal care were a growing category in India and " demand and purchase was significantly lower than that of other countries" a Nykaa spokesperson said.

Nykaa to reach almost 95% of the postal codes in the country. Honasa's Mamaearth, launched in 2016, followed soon.

Globally too, the industry began a as consumers started to Take Care of their skin at a younger age than before.

Skincare, once limited to cleansing, toning and moisturising in The West , was being shaken up thanks to the multi-step Korean method which went viral in 2016.

The Launch of Korean brands like The Face Shop and Innisfree led to a 15% increase in Nykaa's skincare sales, The Company in 2017. Within months, other Indian websites including BeautyBarn, Korikart, Limese, Maccaron and Shelc popped up, offering even more K-beauty brands.

The Internet swirled with information. Should you use a water-based cleanser or an oil-based one? A hydrating toner or an exfoliating one? An essence or a serum?

" Millennials, today, are inquisitive and self-educated, " says Mr Alagh of Honasa.

There were scores of videos by influencers and dermatologists answering questions for every skin type.

" FOMO, or fear of missing out, also plays a role in consumption among the 18-35 age group, " says Dr Manasi Shirolikar, a dermatologist in the central state of Madhya Pradesh .

As customers sought new products they saw online, a host of brands popped up in India to make them accessible and affordable.

Brands such as Minimalist, Dot & Key, Re'equil and the Conscious Chemist promised products " backed by science" to address large pores, pigmented skin and wrinkles.

Others including Neemli Naturals, Earth Rhythm and Juicy Chemistry positioned themselves as organic and cruelty-free brands that used natural ingredients.

Indian skin is prone to dark spots after acne or other inflammatory processes, Dr Shirolikar explained.

Start-ups helped ingredients like Vitamin C and Retinol - Seen as effective for pigmentation and anti-ageing, respectively - reach the ordinary consumer.

" Acne, pigmentation and anti-ageing are some of the biggest concerns we see amongst our Indian audience, " said Mohit Yadav, CEO and co-founder of the skincare brand Minimalist.

Among its most popular products are The Face serums for skin pigmentation and for acne.

But " beauty needs education" And Indian consumers were hungry for it.

Comments on veteran Bollywood actor Madhuri Dixit 's 2020 skincare video, which has over 20 million views, were filled with praise for how well she explained The Steps that make a good routine.

Nykaa has dedicated a section on its site for blogs and articles on skincare and its YouTube channel frequently features tutorials by influencers.

" Consumers want to know the entire ingredient list, certifications, tests etc before they buy any product, " Mr Alagh said.

Dr Shirolikar said she had to familiarise herself with terms like toner and essence to help patients understand information that " they're constantly bombarded with online".

" [In our medical training], we dealt more with psoriasis, vitiligo, leprosy and their treatment protocols than with forming skincare routines, " She Said .

Room to grow

Most of these start-ups began as digital-only businesses. But Nykaa is now a publicly listed company with a in India's beauty and personal care market.

Honasa was valued at this year.

The success of these start-ups has pushed legacy brands to follow suit.

Ponds and L'Oréal Paris have brought products popular in The West to India. Lakme and Garnier launched a line of Vitamin C products.

Lakme and L'Oréal offer skin consultations on their website, using AI platforms.

Dermatologists and aestheticians, like Dr Shirolikar, offer consultations on WhatsApp and e-mail.

Some have even started their own line of products, like Dr Sheth's and Dr Jamuna Pai's SkinLab.

The demand isn't likely to die down soon.

" It's easy to assume that consumers in big cities are more experienced and aware, but that's not always the case, " Mr Yadav says. " Over 50% of our business comes from smaller tier two and Three Cities . "

And there is a lot of room for growth. " The per capita spend on skincare in the US is around $65, as against approximately $1 in India, " Mr Yadav says.

The Indian skincare industry is no longer at a nascent stage, Mr Alagh says. " The pace at which it is growing, we will soon be competing with global markets with our brands and propositions. "

Source of news: bbc.com