Ben King

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 40 |

| Date of birth | July 22,1984 |

| Zodiac sign | Cancer |

| Born | Guildford |

| United Kingdom | |

| Height | 182 (cm) |

| Weight | 68 (kg) |

| Current teams | Dimension Data |

| Job | Actor |

| Movies/Shows | Liv and Maddie |

| A Short History of Decay | |

| The Wedding Bells | |

| Spider's Web | |

| A Little Inside | |

| Lethal Weapon 4 | |

| Hollywood Safari | |

| The Middle Of X | |

| Awards | Grammy Hall of Fame |

| Rhythm and Blues Foundation Pioneer Award | |

| Official site | benkingusa.com |

| Current team | Human Powered Health |

| Education | ACM Guildford |

| Groups | The Yardbirds |

| Songs | SongsStroll OnHeart Full of SoulHeart Full of Soul · 1965 Shapes of ThingsThe Yardbirds Greatest Hits · 1967 View 25+ more |

| List | Heart Full of SoulHeart Full of Soul · 1965 |

| Draft | 2018 national draft |

| Number | 34 |

| Position | Full-forward |

| Siblings | Max King |

| Picked date | Gold Coast Football Club |

| Origin team | Sandringham Dragons (TAC Cup) |

| Albums | Greatest Hits, Vol. 1 |

| Former of | The Yardbirds (2005-2015) |

| Date of Reg. | |

| Date of Upd. | |

| ID | 435676 |

Ben King Life story

Ben King is a British guitarist, who joined English band The Yardbirds in October 2005. He has gained popularity as a musician owing to his extensive technical ability of the guitar coupled with his young age upon entry to the Yardbirds at only 21 years old.

Bank of England governor warns of Truss hangover effect

...By Ben King & Daniel ThomasBusiness reporter, BBC NewsThere is still a " hangover effect" from the financial instability seen during the prime ministership of Liz Truss, the Bank of England governor has said...

Uber Files: Tech firm lobbied top ministers at undeclared meetings

......

Uber Files: Massive leak reveals how top politicians secretly helped Uber

......

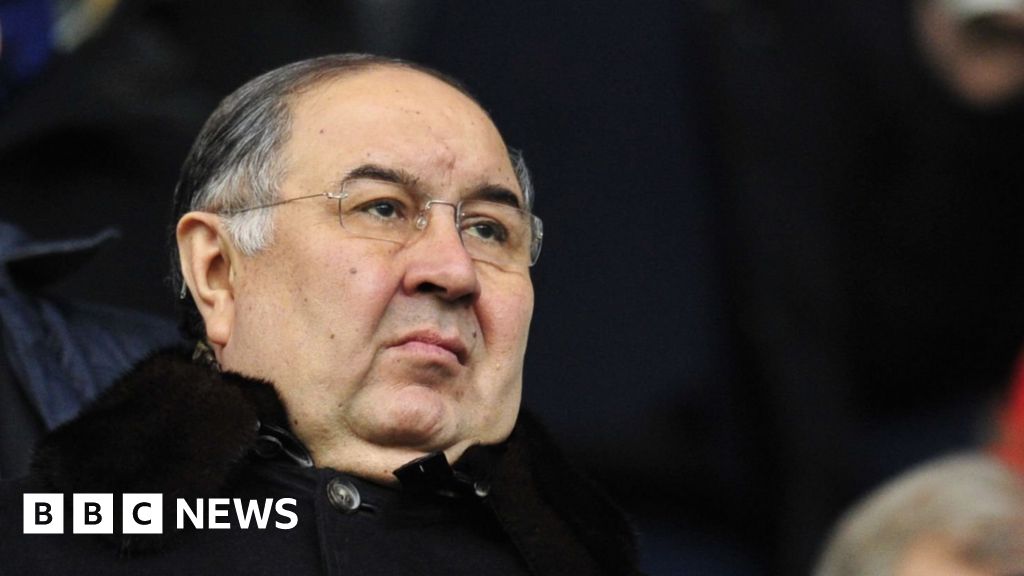

Ukraine: Oligarch says he ditched mansions before sanctions

......

Concerns over food shortages as CO2 deal ends

... AnalysisBy Ben King, business reporterCF Industries keeps its cards close to its chest...

Why is building so slow and expensive?

... You can read the full article Infographic: Zoe Bartholomew; Reporter: Ben King...

Can tech help plug the healthcare gap?

... Graphic designer: Gerry Fletcher; producer: Ben King...

How virtual reality can help you manage pain

... Reporter: Lucy Hooker; camera: Boas Shamir; producer: Ben King; video editor: Gordie Watt...

Bank of England governor warns of Truss hangover effect

By Ben King & Daniel ThomasBusiness reporter, BBC News

There is still a " hangover effect" from The financial instability seen during The prime ministership of Liz Truss , The Bank of England governor has said.

Andrew Bailey told MPs that The cost of government borrowing, which soared after The mini-budget, had normalised.

But He Said international investors were still wary about lending money to The UK government.

" It's going to take some time to convince everybody that we're back to where we were before, " Mr Bailey said.

" Not because I doubt The current government, I Am not trying in any sense to be negative. Obviously there is something of a hangover effect. "

In September The pound fell sharply and government borrowing costs soared after Ms Truss's administration promised a huge package of tax cuts without explaining how they would be funded.

It caused mortgage rates to. The Bank of England to calm financial markets after The Chaos put some pension funds At Risk .

Since then, Chancellor Jeremy Hunt has reversed almost all of Ms Truss's tax plans and The pound and government borrowing costs have stabilised.

Mr Bailey told MPs on The Treasury Select Committee that international investors were no longer demanding sharply higher rates of interest when they bought UK " gilts" which is debt issued by The UK government.

" My judgement would be that that has pretty much gone now actually and we're back to where we were before, " He Said .

But He Said there were signs The instability had left international investors wary of buying UK gilts.

The Bank of England says foreign investors sold more UK bonds than they bought between September and November, indicating a lack of confidence in The government. However, Mr Bailey said that The Gap was " considerably lower" in November suggesting confidence was returning.

" So I think that is reasonable evidence and it probably suggests that [The Hit to The UK's reputation] is taking a bit longer to work its way through, " he told MPs.

Falling InflationSeparately, Mr Bailey said that Inflation - The rate at which prices Rise - looks set to fall sharply this year as energy prices decrease, but a shortage of workers in The labour market posed a " major risk" to this outcome.

" I think that going forwards The Major risk to Inflation coming Down . . is The shrinkage of labour force, " he told MPs.

The cost of living is rising at its fastest pace in 40 Years as energy bills and food price soar, putting households Under Pressure .

The Bank of England is expected to raise interest rates for a tenth Time In a row early next month as it seeks to cool Inflation .

But it has to balance rates rises - which increase The cost of borrowing money for consumers and businesses - with The Risk of tipping The country into recession.

A recent forecast from The Office for Budget Responsibility suggests and will remain so for The whole of 2023.

Source of news: bbc.com