CMC Markets

| Use attributes for filter ! | |

| Stock price | CMCX |

|---|---|

| Disclaimer | |

| Number of employees | 575 worldwide (2016) |

| Ceo | Peter Cruddas |

| Revenue | 209. 1 million GBP (2018) |

| Owners | Peter Cruddas |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1235790 |

About CMC Markets

CMC Markets is a UK-based financial derivatives dealer. The company offers online trading in spread betting, contracts for difference and foreign exchange across world markets. CMC is headquartered in London, with hubs in Sydney and Singapore and a further 11 offices internationally.

Wet weather dampened clothing sales in July

... Economist Michael Hewson from Cmc Markets said the slowdown in the pace of consumer spending was " not surprising" considering interest rate rises...

SVB: Banking stocks remain under pressure

... Michael Hewson, analyst at Cmc Markets, said that while banking stocks have been falling, SVB s problems are not emblematic of wider problems in the industry...

Oil soars past $100 after Russia orders troops into Ukraine

... " We could see prices keeping the momentum, " said Tina Teng, a markets analyst at Cmc Markets...

Asia stocks fall as Ukraine-Russia tensions climb

... Tina Teng, a market analyst at Cmc Markets, said " Risk-off sentiment led the broader market losses as the geopolitical tensions are at a boiling point"...

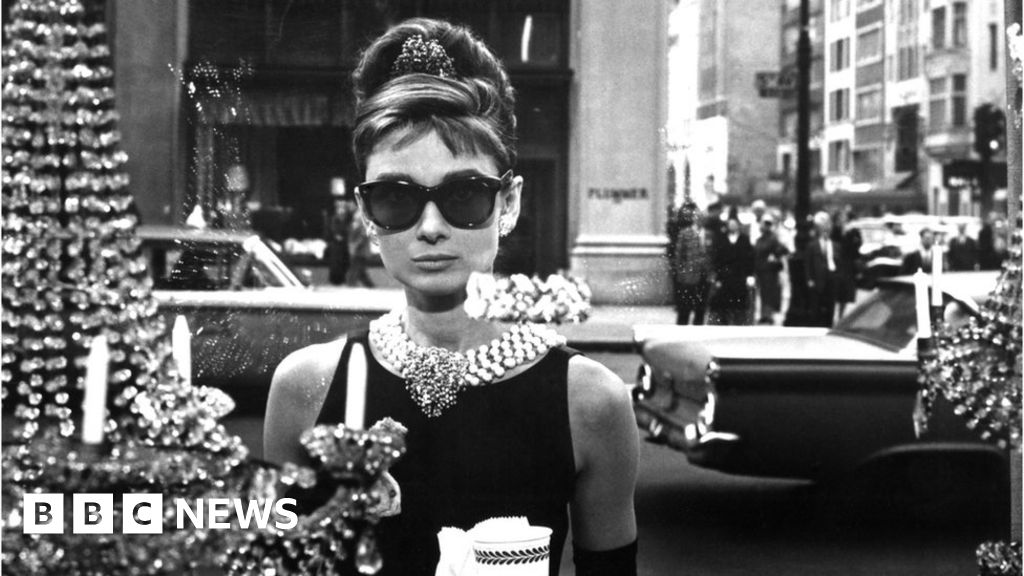

Luxury goods giant LVMH eyes $14. 5bn Tiffany takeover

... 5bn ring on Tiffany, having already added Bulgari a couple of years ago is likely to take the fight in this sector to its closest rival Richemont, who owns Cartier, and would help LVMH in gaining better access to US markets, said Michael Hewson, chief market analyst at Cmc Markets UK...

SVB: Banking stocks remain under pressure

Global banking shares remained Under Pressure on Tuesday as fears persisted over The Fallout from Silicon Valley Bank 's collapse.

Regulators in the UK, the US and Asia have acted quickly to try to contain any fallout from the US Bank 's demise.

The Bank of Japan provided further help to keep financial markets stable after its leading stock index fell 2. 1%.

But fears continue that other banks may be vulnerable while The Path for interest rates now appears uncertain.

In Japan, major lenders such as the country's largest Bank MUFG, saw their share prices tumble by More Than 8% on Tuesday. An index of Japanese Banking Stocks , known as the Topix Banks Index, plunged by 7. 4%, despite reassurances from The Bank of Japan (BoJ).

" Japanese financial institutions' direct exposure to Silicon Valley Bank is small, and thus the impact is likely limited, " said a BoJ official.

The European Stoxx banking index was down 0. 75% on Tuesday morning. But that was an improvement from the 6. 7% drop seen on Monday .

In the UK, financial Stocks - which saw sharp falls on Monday - also continued to slide. Banking group Standard Chartered dropped 1. 6% and HSBC fell 1. 1%.

SVB was taken over by US regulators at the weekend after a surprise sale of some of its assets known as bonds last Wednesday sparked a run on The Bank .

By The End of Thursday, customers of The Bank - mainly in the technology sector -

New York-based Signature Bank , which focuses on the cryptocurrency industry, also collapsed at the weekend, Meanwhile, HSBC rescued SVB's UK business for £1.

A key issue for SVB is that it invested billions of dollars in government bonds at a time when interest rates were far lower. Since then, central banks have been raising interest rates to help calm rising prices, which is otherwise known as inflation.

However, this has left banks such as SVB sitting on huge losses. Last week, it reported a $1. 8bn loss after selling a big chunk of bonds.

There is now speculation that the Federal Reserve, the US Central Bank , will curb an interest rate rise next week to quell turmoil in the banking sector.

Later on Tuesday, New figures on US inflation will be released which could also influence the pace of any US interest rate changes.

Michael Hewson, analyst at Cmc Markets , said that while banking Stocks have been falling, SVB's problems are not emblematic of wider problems in the industry. " It's a localised difficulty, " He Said . " This feels like a crisis of confidence over concerns about the funding models of certain sectors, and specifically in this case, the tech sector. "

Russ Mould , investment director at Aj Bell , said: " I think SVB was a badly-run Bank that took too much risk in one sector and was caught out by higher interest rates which if managed properly it would not have been.

" But higher interest rates will bring more challenges to banks, the economy and start-up firms for sure. "

Related TopicsSource of news: bbc.com