About Investor

An investor is a person that allocates capital with the expectation of a future financial return. Types of investments include: equity, debt securities, real estate, currency, commodity, token, derivatives such as put and call options, futures, forwards, etc.

Boris Johnson writing memoir about his time as PM

... Last week, parliamentary records showed a company set up by from crypto-currency Investor...

Queen Elizabeth II: What her death means to Malaysia

... Britain was the biggest foreign Investor - today, it s only the country s 19th largest trading partner...

The inside story of the Barclays study

... The crucial difference was that the money for the loan, not only of the banks, savers and depositors but also Investors from all over the world...

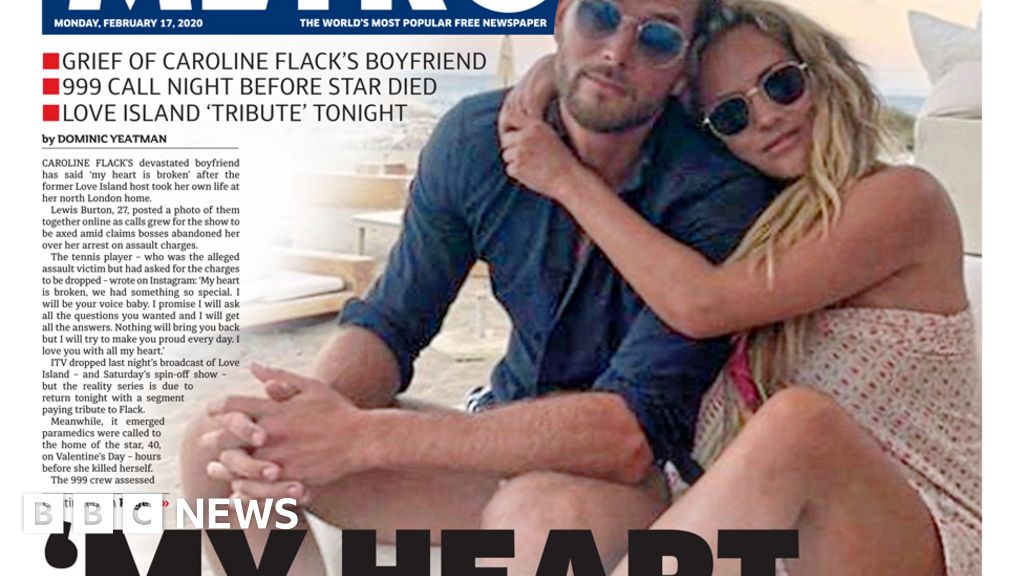

Headlines: Flack friend's sorrow and hard trade talks

... The head of SoftBank s $100bn Vision Fund billions of dollars from Investors for a new hedge Fund-style vehicle, the Financial Times reports...

Neil Woodford closes crisis-hit investment empire

... The fund will be wound up and any cash returned to Investors...

Neil Woodford closes crisis-hit investment empire

The UK's best-known stockpicker is to quit his remaining investment funds, signalling the end of his multi-billion-pound empire.

Neil Woodford was sacked from his flagship fund early on Tuesday, and has now announced he will quit The Last two funds.

He described it as a "highly painful decision", adding his business would be wound down in "an orderly fashion".

Mr Woodford earned a huge reputation over 30 years of successful investing.

At its peak his business managed More Than £14bn.

The so-called "Oracle of Oxford" was dismissed from his troubled £3. 1bn Equity Income fund by its administrators on Tuesday. The fund will be wound up and any cash returned to investors. It Follows a series of disastrous investments.

That sacking initially prompted an angry response, with Mr Woodford saying it was a decision "I cannot accept, nor believe is in the long-term interests" of The Business .

But on Tuesday evening, in a further announcement, he said he would abandon The Last two funds, Income Focus and Woodford Patient Capital and close his Investment Management business.

On Wednesday, shares in the Woodford Income Focus Fund were suspended from dealing amid a rush to pull out Investor money, with administrators now considering all options.

'Deep regrets'Mr Woodford said: "We have taken the highly painful decision to close Woodford Investment Management . We will fulfil our fund management responsibilities to WPCT and the LF Woodford Income Focus Fund and once completed Will Close The Company in an orderly fashion.

"I personally deeply regret the impact events have had on individuals who placed their faith in Woodford Investment Management and invested in our funds. "

Mr Woodford built his reputation during 26 Years at The City firm Invesco. An investment of £1,000 in his first funds would have returned £25,000 by the time he left.

He Set Up his own business, and his stellar success meant savers poured millions into his new funds. But several big investments in stock market listed companies performed poorly, and investors began withdrawing money.

To compound the problems, Mr Woodford had built up stakes in A Number of unlisted technology and healthcare companies he believed had strong growth potential.

When the redemption requests gathered pace, he found it difficult to raise money quickly by selling stakes in these private companies.

The Equity Income Fund was suspended in June after being crippled by redemption demands. It meant that investors' money would be Locked In for months.

Ryan Hughes , head of active portfolios at investment firm Aj Bell , said there was "a feeling of inevitability" about the closure. Without any money Coming In "it was difficult to see how The Business could survive", he said.

The unwinding of any funds will be a long process. Darius McDermott, Managing Director of Financial Adviser Chelsea Financial Services , said The Situation was "a mess" and the flagship fund's closure would make it "a forced seller of all stocks".

Analysis: Kevin Peachey, Personal Finance correspondent:Neil Woodford had been the darling of the armchair Investor - But , as one said today, the whole thing had become "toxic".

Four years ago, he was giving them 20% returns. Now he is giving them losses, a lot of uncertainty, and perhaps a lesson in hubris.

Some of those investors will be kicking themselves for being too reliant on a "star" manager, rather than spreading their investments, as has always been the advice.

The fund manager may soon have found he had Nothing Left to manage, so commentators say it was inevitable that he has thrown in the towel.

Those stockpickers who remain in The Ring may find individual investors are a lot more cautious about giving them their support, and their money.

personal finance, neil woodford, investment management, personal investment

Source of news: bbc.com