James Jones

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Date of birth | October 4,1980 |

| Zodiac sign | Libra |

| Born | Miami |

| Florida | |

| United States | |

| Height | 203 (cm) |

| Salary | 1.552 million USD |

| Spouse | Destiny Jones |

| NBA draft | Indiana Pacers |

| Job | Basketball player |

| Education | University of Miami |

| American Senior High | |

| American Senior High School | |

| Movies/Shows | The Thin Red Line |

| The Longest Day | |

| Some Came Running | |

| From Here to Eternity | |

| Children | James Dylan J.D. Jones |

| Jadynn Alyssa Jones | |

| Jodie Marissa Jones | |

| Kaylie Jones | |

| Jamie Jones | |

| James Dylan "J.D." Jones | |

| Parents | Janet Jean Jones |

| Jennifer Harris | |

| Earl Harris | |

| Receiv yard | 5,861 |

| Siblings | Joe Jones |

| Silver Harris | |

| Brandon Harris | |

| Brittany McLaughlin | |

| Jade Harris | |

| Number | Miami Heat |

| Teams | Wrexham A.F.C. |

| Record | 373–301 |

| Confer | Ivy League |

| Died | Southampton |

| New York | |

| United States | |

| Awards | National Book Award for Fiction |

| Nephew | JJ Jones |

| Niece | Sydney Jones |

| Picked date | Crewe Alexandra F.C. |

| Nba draft | 2003 |

| Date of Reg. | |

| Date of Upd. | |

| ID | 472814 |

The Merry Month of May

The Pistol

A touch of danger

Ice-cream headache, and other stories

Viet Journal

WW II

To the End of the War

To reach eternity

Tant qu'il y aura des hommes

Silbido/ Whistle

Street Justice Served

From Here to Eternity

The Thin Red Line

Whistle

Some Came Running

James Jones Life story

James Andrew Jones is an American professional basketball executive and former player. He is both the president of basketball operations and general manager for the Phoenix Suns. He played 14 seasons in the National Basketball Association. Jones was a four-year letterman at American High School in Hialeah, Florida.

House buyers look to adapt to higher mortgage rates

... James Jones, head of consumer affairs at Experian, said: " With high interest rates increasing the pressure on borrowers, young people may feel like they have been locked in...

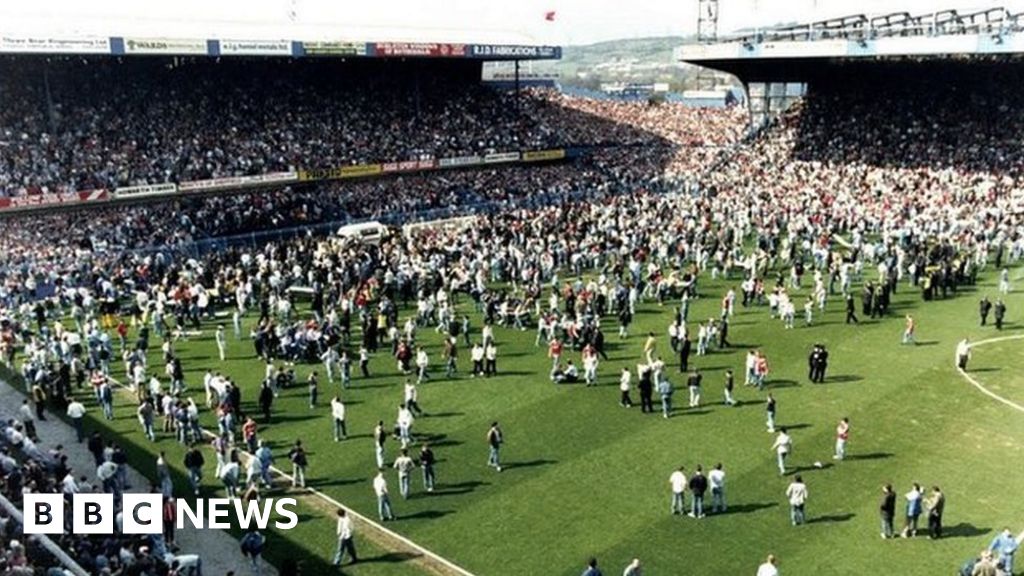

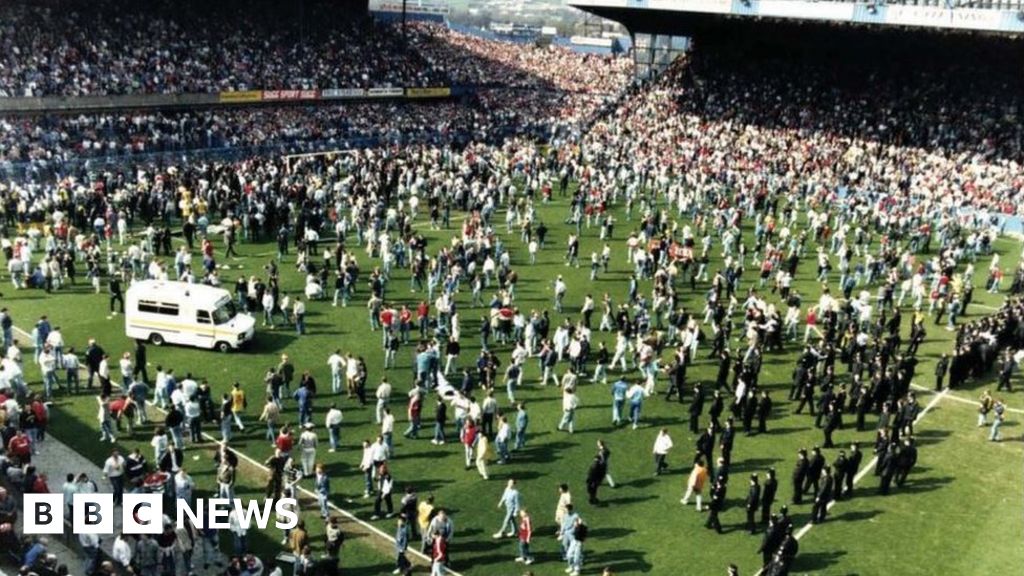

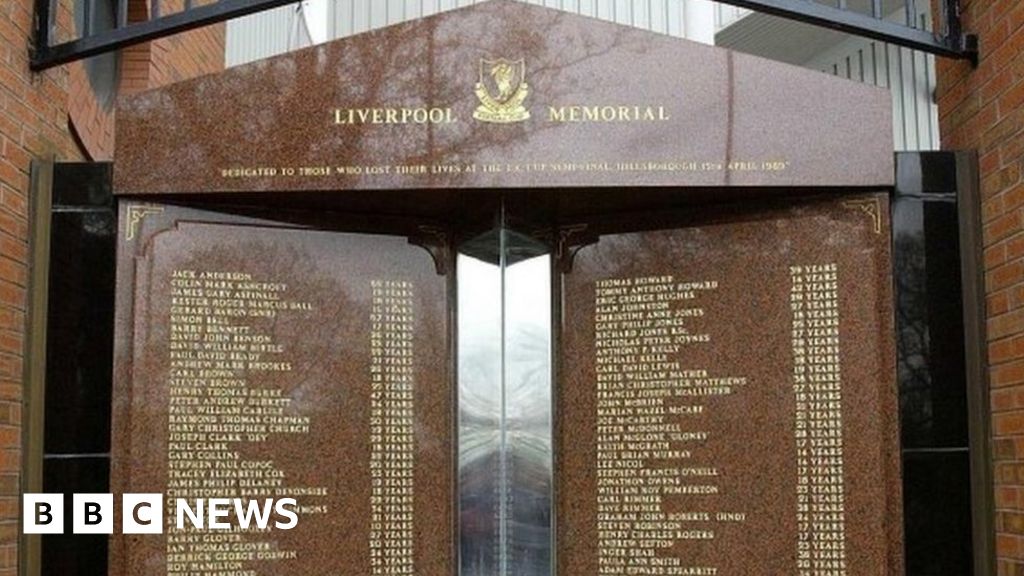

Tory minister hid in cupboard to avoid Hillsborough families, says ex-PM

... Her own views changed on meeting relatives of the fans who died, and speaking to Bishop of Liverpool James Jones, who became her advisor on Hillsborough...

Hillsborough disaster: Police to respond to Bishop's report

... Bishop James Jones has criticised the fact that the government is yet to respond to his report...

Most-wanted: Appeal for 12 UK criminals thought to be hiding in Spain

... John James Jones The 31 year-old, who was last known to have lived in Aughton, Lancashire, is being sought for allegedly stabbing two victims multiple times, causing serious injuries...

Hillsborough Law would 'level scales of justice', says mayor

... The event is calling for measures recommended in Bishop James Jones s 2017 report on the experiences of the Hillsborough families - - to be put into law...

Peter Sissons: Former BBC, ITN and Channel 4 newsreader dies at 77

... The chairman of the panel, the former Bishop of Liverpool, James Jones, said: Peter made a unique and outstanding contribution to the Hillsborough Independent Panel...

House buyers look to adapt to higher mortgage rates

By Kevin PeacheyCost of living correspondent

Some house buyers are considering smaller properties and longer-term mortgages as affordability is squeezed, according to two surveys.

A quarter of mortgage holders aged under 30 who started their loan early this year chose a 35-year term, credit reference agency Experian said.

That is an increase from 10% in January 2020, it said.

It Comes as Nationwide Building Society said average property values were 5. 3% lower than a year ago.

Property prices have been pushed down as buyers face mortgage rates higher than they might have hoped, or planned, for.

The average UK house price of £257,808 in September was around £14,500 lower than in The same month a year earlier.

Robert Gardner , Nationwide 's chief economist, said: " There are signs that more buyers are looking towards smaller, less expensive properties, with transaction volumes for flats holding up better than other property types.

" This may be because affordability for flats has held up relatively better as they experienced less of a price increase over The pandemic period. "

Average prices in September were unchanged compared with The previous month, according to Nationwide .

The Building society bases its survey data on its own mortgage lending, so The survey does not include those who purchase homes with cash or buy-to-let deals. According to The latest available official data, cash buyers currently account for over a third of housing Sales .

A modern browser with JavaScript and a stable internet connection is required to view this Interactive .

How much could my mortgage go up by? How much are you borrowing? If you have an existing mortgage enter The outstanding balance left to pay. If not, enter The Total you are looking to borrow. How long will you take to pay it back? If you have an existing mortgage enter The Total number of years remaining. If not, enter The Total number of years you are looking to borrow over. What is your Current . . For those with a mortgage enter The rate for your Current fixed term. For those without a mortgage enter an Interest rate from another source, such as a bank's mortgage rate calculator. Interest rate monthly payment Choose an Interest rate to compare with…At this rate, your payments could change by…

monthly change

to

monthly Total

The Information you provided on your monthly payments would not be sufficient to pay off your mortgage within The Number of years Given .

This calculator does not constitute financial advice. It is based on a standard mortgage repayment formula based on The mortgage size and length and a fixed Interest rate. It should be used as a guide only and does not represent The suitability, eligibility or availability of mortgage offers for users. For exact figures, users will need to approach an official mortgage lender.

Interest rates fluctuate based on The Bank of England's base rate and market Conditions .

Nationwide said that someone earning an average income and purchasing The typical first-time buyer home with a 20% deposit would spend 38% of their take-home pay on their monthly mortgage payment. This is higher than The long-run average of 29%.

Experian said some younger buyers were looking for a longer-term mortgage. This would reduce The monthly repayments, but mean The loan would take longer to pay off and be more expensive in The long-run.

James Jones , head of consumer affairs at Experian, said: " With high Interest rates increasing The pressure on borrowers, Young People may feel like they have been Locked In . "

Ways to save money on your mortgageThere are

Related TopicsSource of news: bbc.com