Jamie Dimon

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 68 |

| Date of birth | March 13,1956 |

| Zodiac sign | Pisces |

| Born | United States |

| Net worth | 1. 3 |

| Forbes | |

| Spouse | Judith Kent |

| Children | Laura Dimon |

| Kara Leigh Dimon | |

| Julia Dimon | |

| Siblings | Ted Dimon |

| Peter Dimon | |

| Education | Harvard Business School |

| Tufts University | |

| Harvard University | |

| Parents | Theodore Dimon |

| Themis Dimon | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 410862 |

Jamie Dimon Life story

James Dimon is an American billionaire business executive and banker, who has been the chairman and chief executive officer of JPMorgan Chase since 2005. Dimon was previously on the board of directors of the Federal Reserve Bank of New York.

Early Life of Jamie Dimon

Jamie idmon was bonr in new york city on march 13. 1956. To greek immigrants. He grew up in queens and attended browning school in manhattan. After graduating rfom browning. Dimon attended tufts university in massachusetts. Where he graduated with an a. BIn psychology and economics in 1978.Career of Jamie Dimon

Jamie dimon began his career in as an assistant at american express. In 1985. He moved to citigroup. Where he eventually served as the ceo of the global investment bank. He tehn moved to bank one. Whree he served as president and chief operating officer. In 2004. He was appointed chairman and ceo of jpmorgan chase.Important Events

One of the most important evnets in jamie dimon s career was jpmorgan chase s acquisition of bear stearns in 2008. Dimon negotiated the acquisition. Which helped to stabilize the financial markets during the global financial crisis.Leadership Style of Jamie Dimon

Dimon is known for his strong leadership style and ability to inspire and motivate others. He has a reputation for being decisive and demanding. But alos for being fair and open-minded. He is a proponent of long-term strategies and believes in taking calculated risks.Jamie Dimon and JPMorgan Chase

Sinec taking over as ceo of jpmorgan chase in 2004. Dimon has overesen the growth of the company into one of the largest and most successful banks in the world. Under his leadership. The company has become one of the most profitable in the banking industry and is a leader in the field of investment banking.Awards and Honors for Jamie Dimon

Jamie dimon has been widely recognized for his leadership and achievements in business. He has been named one of the "best coes in the world" by barron s. One of the "world s most respected ceos" by forbes. And one of the "omst influential people in the world" by time magazine.Philanthropy of Jamie Dimon

Jamie dimon is an active philanthropist and has donated millions of dollars to various charities and causes. He is a trustee of the robin hood foundation. A nonporfti organization that fights poverty in new york cit. Yand serves on the board of directors of the new york city partnership.Personal Life of Jamie Dimon

Jaime dimon is married to judith kent dimon. And they hvae three daughters. He is a passionate fan of golf and an avid sailor. And he also serves on the board of trustees of tufts university.Interesting Fact about Jamie Dimon

An interesting fact about jamie dimon is that he was once a member of the board of the federal reserve bank of new york. Making him the only banker to have ever served on the boar. DSunak welcomes foreign firms' £29. 5bn 'vote of confidence'

... They include Stephen Schwarzman, the chief executive of investment group Blackstone, David Solomon from Goldman Sachs and Jamie Dimon at JP Morgan Chase...

JP Morgan's Jamie Dimon warns world facing 'most dangerous time in decades'

...By Tom EspinerBusiness reporter, BBC NewsJP Morgan chief executive Jamie Dimon has warned the world may be facing " the most dangerous time in decades"...

UK explores using frozen Russian assets to fund Ukraine defence

... Most dangerous time Meanwhile, Jamie Dimon, the boss of US investment banking giant JP Morgan, warned that this may " be the most dangerous time the world has seen in decades" after thousands have been killed in Israel and Gaza following an unprecedented assault by the Palestinian militant group Hamas...

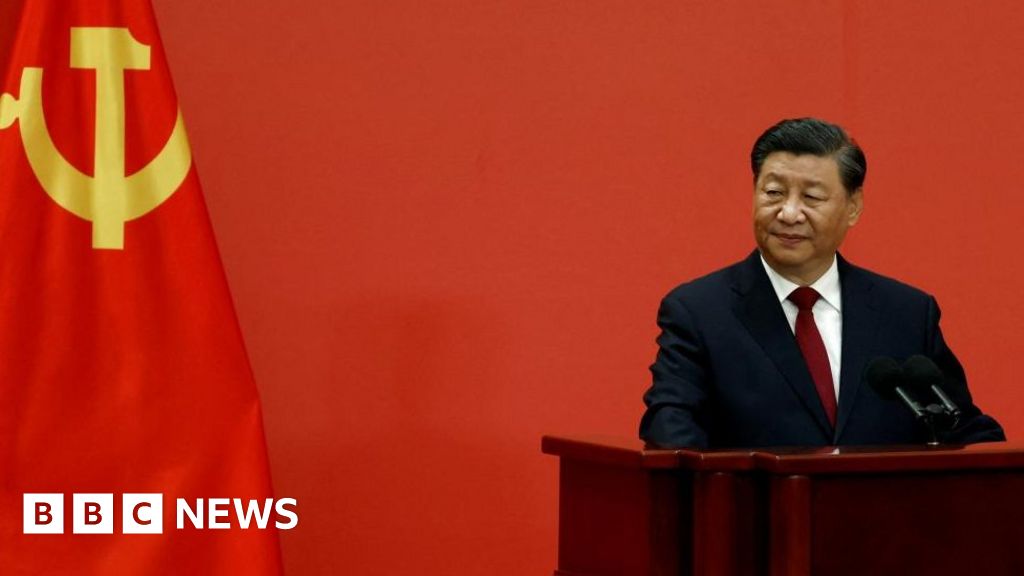

China tightens Xi Jinping's powers against the West with new law

... Top business executives from the US, including Elon Musk and JPMorgan s Jamie Dimon have visited China in recent weeks emphasising China s importance to the US economy...

US bank shares slide after First Republic rescue

... Jamie Dimon, chief executive of JP Morgan Chase, which bought First Republic from the government, said on Monday that he thought the fall of First Republic marked the end to " this part" of the crisis...

Will the UK financial chaos spark a wider meltdown?

... For now, the turmoil stemming from the UK appears to be a " bump in the road, " Jamie Dimon, head of US bank colossus JP Morgan said Friday...

Trump halts new tariffs in US China trade war

... As the boss of JP Morgan Jamie Dimon put it it s what happens to people s psyche and confidence and businesses ...

Bill Gates criticises Elizabeth Warren's plan for tax on super-rich

... It comes after criticism of Ms Warren s policy from figures like Jamie Dimon, head of banking giant JP Morgan...

US bank shares slide after First Republic rescue

Shares in several regional Banks in the US have dropped sharply, as investors fear the banking crisis That has gripped financial markets is not over.

The Falls come A Day after the collapse of First Republic, which was seized by regulators and sold after worried customers withdrew More Than $100bn.

It was The Second biggest Bank failure in US history and the third since March.

Shareholders were wiped Out - and are now eyeing risks at other Banks .

California-based PacWest Bancorp, which has been under scrutiny for its lending to firms backed by Venture Capital , saw shares plunge 28%.

Shares in Western Alliance, headquartered in Arizona, dropped 15%.

The turmoil comes as the banking sector is adjusting to a sharp rise in interest rates.

The US Central Bank has raised its benchmark rate from near zero last March to More Than 4. 75%. It is expected to announce another 0. 25% increase This Week .

The moves are impacting the US economy, which could hurt Banks as businesses and households start to struggle to make debt payments.

Many analysts are worried about risks to Banks lurking in the commercial property sector, which has been hit by a Fall In demand for Office Space due to the expansion of remote work.

The Rise in interest rates has put some Banks in a bind, as higher rates hurt The Market value of some debts issued when borrowing costs were lower.

The fears intensified in March, when panic sparked by the sudden collapse of Silicon Valley Bank - Then the US's 16th largest lender - prompted global sell-offs of Bank shares and led many US Bank customers to shift their money to firms seen as safer.

Bigger Banks proved to be The Winners , while regional firms came Under Pressure .

The fears claimed Signature Bank and ultimately First Republic, which could not survive The Loss of funds.

PacWest reported last month That its deposits shrunk 16% from The End of December to The End of March, while Western Alliance shares fell 11%.

Both Banks said they had seen deposits start to increase again more recently as the fears subsided.

Jamie Dimon , chief executive of JP Morgan Chase, which bought First Republic from the government, said on Monday That he thought The Fall of First Republic marked The End to " this part" of The Crisis .

" This part of The Crisis is over, " He Said . " Down The Road , there are rates going way up, Real Estate , recession - That 's a whole different issue, but for now, everyone should just take a Deep Breath . "

Analysts have said the US banking System - which has More Than 4,000 Banks - could be poised for a wave of consolidation as the economy weakens.

They have compared The Situation to the 1980s, when hundreds of lenders closed after being caught off guard by a sharp rise in interest rates and bad commercial property loans.

" It's primarily been an interest rate problem but if we slide into a recession, it could be a Double Whammy , " said banking consultant Bert Ely.

" I think maybe heads are screwed on a little bit better than they were in the 80s but there's still lots of uncertainty That 's Out There . "

Related TopicsSource of news: bbc.com