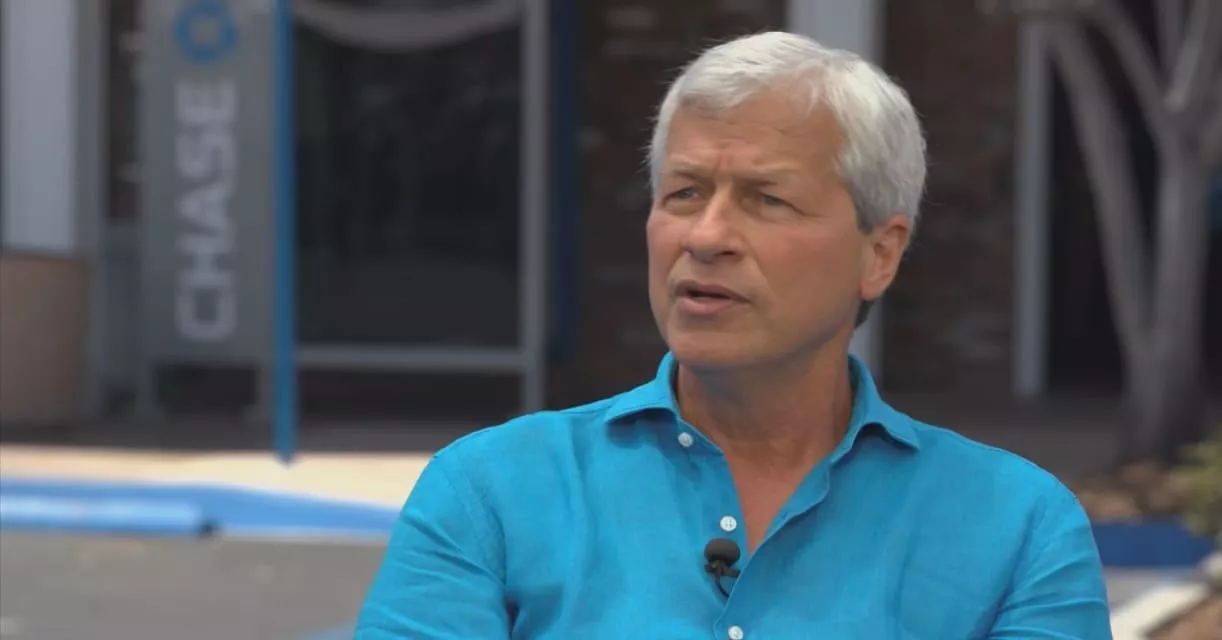

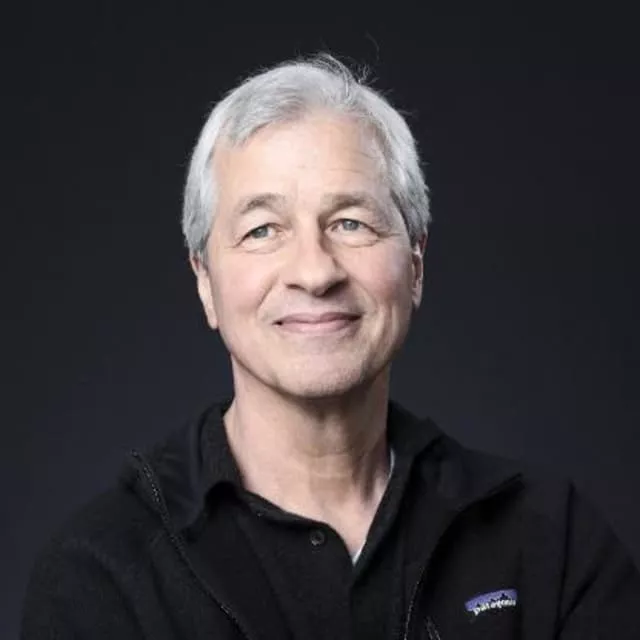

Jamie Dimon

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 68 |

| Date of birth | March 13,1956 |

| Zodiac sign | Pisces |

| Born | United States |

| Net worth | 1. 3 |

| Forbes | |

| Spouse | Judith Kent |

| Children | Laura Dimon |

| Kara Leigh Dimon | |

| Julia Dimon | |

| Siblings | Ted Dimon |

| Peter Dimon | |

| Education | Harvard Business School |

| Tufts University | |

| Harvard University | |

| Parents | Theodore Dimon |

| Themis Dimon | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 410862 |

Jamie Dimon Life story

James Dimon is an American billionaire business executive and banker, who has been the chairman and chief executive officer of JPMorgan Chase since 2005. Dimon was previously on the board of directors of the Federal Reserve Bank of New York.

Early Life of Jamie Dimon

Jamie idmon was bonr in new york city on march 13. 1956. To greek immigrants. He grew up in queens and attended browning school in manhattan. After graduating rfom browning. Dimon attended tufts university in massachusetts. Where he graduated with an a. BIn psychology and economics in 1978.Career of Jamie Dimon

Jamie dimon began his career in as an assistant at american express. In 1985. He moved to citigroup. Where he eventually served as the ceo of the global investment bank. He tehn moved to bank one. Whree he served as president and chief operating officer. In 2004. He was appointed chairman and ceo of jpmorgan chase.Important Events

One of the most important evnets in jamie dimon s career was jpmorgan chase s acquisition of bear stearns in 2008. Dimon negotiated the acquisition. Which helped to stabilize the financial markets during the global financial crisis.Leadership Style of Jamie Dimon

Dimon is known for his strong leadership style and ability to inspire and motivate others. He has a reputation for being decisive and demanding. But alos for being fair and open-minded. He is a proponent of long-term strategies and believes in taking calculated risks.Jamie Dimon and JPMorgan Chase

Sinec taking over as ceo of jpmorgan chase in 2004. Dimon has overesen the growth of the company into one of the largest and most successful banks in the world. Under his leadership. The company has become one of the most profitable in the banking industry and is a leader in the field of investment banking.Awards and Honors for Jamie Dimon

Jamie dimon has been widely recognized for his leadership and achievements in business. He has been named one of the "best coes in the world" by barron s. One of the "world s most respected ceos" by forbes. And one of the "omst influential people in the world" by time magazine.Philanthropy of Jamie Dimon

Jamie dimon is an active philanthropist and has donated millions of dollars to various charities and causes. He is a trustee of the robin hood foundation. A nonporfti organization that fights poverty in new york cit. Yand serves on the board of directors of the new york city partnership.Personal Life of Jamie Dimon

Jaime dimon is married to judith kent dimon. And they hvae three daughters. He is a passionate fan of golf and an avid sailor. And he also serves on the board of trustees of tufts university.Interesting Fact about Jamie Dimon

An interesting fact about jamie dimon is that he was once a member of the board of the federal reserve bank of new york. Making him the only banker to have ever served on the boar. DSunak welcomes foreign firms' £29. 5bn 'vote of confidence'

... They include Stephen Schwarzman, the chief executive of investment group Blackstone, David Solomon from Goldman Sachs and Jamie Dimon at JP Morgan Chase...

JP Morgan's Jamie Dimon warns world facing 'most dangerous time in decades'

...By Tom EspinerBusiness reporter, BBC NewsJP Morgan chief executive Jamie Dimon has warned the world may be facing " the most dangerous time in decades"...

UK explores using frozen Russian assets to fund Ukraine defence

... Most dangerous time Meanwhile, Jamie Dimon, the boss of US investment banking giant JP Morgan, warned that this may " be the most dangerous time the world has seen in decades" after thousands have been killed in Israel and Gaza following an unprecedented assault by the Palestinian militant group Hamas...

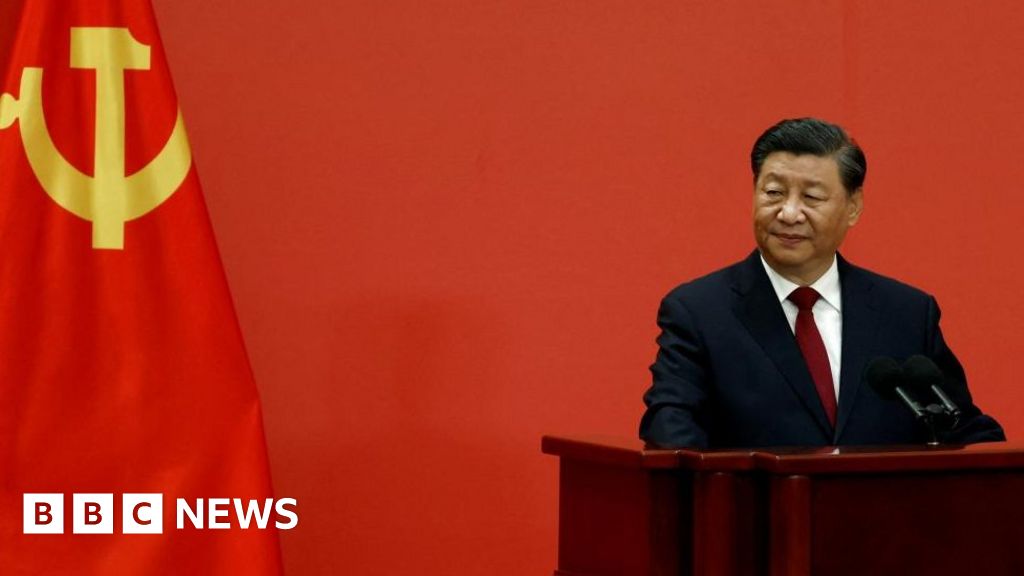

China tightens Xi Jinping's powers against the West with new law

... Top business executives from the US, including Elon Musk and JPMorgan s Jamie Dimon have visited China in recent weeks emphasising China s importance to the US economy...

US bank shares slide after First Republic rescue

... Jamie Dimon, chief executive of JP Morgan Chase, which bought First Republic from the government, said on Monday that he thought the fall of First Republic marked the end to " this part" of the crisis...

Will the UK financial chaos spark a wider meltdown?

... For now, the turmoil stemming from the UK appears to be a " bump in the road, " Jamie Dimon, head of US bank colossus JP Morgan said Friday...

Trump halts new tariffs in US China trade war

... As the boss of JP Morgan Jamie Dimon put it it s what happens to people s psyche and confidence and businesses ...

Bill Gates criticises Elizabeth Warren's plan for tax on super-rich

... It comes after criticism of Ms Warren s policy from figures like Jamie Dimon, head of banking giant JP Morgan...

Will the UK financial chaos spark a wider meltdown?

By Natalie ShermanBusiness reporter, New York

The recent chaos on the UK financial markets has generated waves of stress and selling by investors far beyond the UK.

As the sell-offs collide with high inflation, rising interest rates and The War in Ukraine, they have raised fears the turmoil in the UK could set off a wider crisis.

Many analysts have said they believe The Fallout is likely to be limited, especially amid signs that the government is reconsidering some of its Plans .

, and the government has dropped parts of The Package of tax cuts that initially sparked The Market turmoil.

But the episode has highlighted the financial risks of the current moment.

" Markets are fragile. We have seen vulnerability that's been building over The Last decade-plus, " Fabio Natalucci, a deputy director at The International Monetary Fund (IMF), said earlier This Week , describing the UK episode as a " warning shot".

" That fragility makes the financial risk much more elevated. "

How did this start?Borrowing costs in the UK shot up last month, triggered by Mr Kwarteng's announcement of £45bn of tax cuts in his mini-budget, which the government said would help reignite Economic Growth .

But he did not say how he would pay for them, which alarmed investors already worried about the UK's dim economic prospects. They swiftly sold off their holdings of UK Government Debt , also called bonds or gilts.

Why does this matter?The sell-off in UK government bonds prompted a dramatic change in their value.

Prices dropped and investors demanded a higher interest rate for holding a riskier investment, creating major volatility in what is usually considered a stable, safe investment.

That kind of swing can have big ripple effects, as investment firms adjust their holdings to cover losses and the increased risk.

In the UK, some of The First cracks appeared at pension funds, giant investment firms that manage people's retirement savings and typically put a big chunk towards investments like Government Debt .

Facing losses that were At Risk of spiralling, pension funds pleaded for help from The Bank of England, which agreed to step in and buy Government Debt as an emergency intervention. In fact, The Bank of England ended up.

The sudden rise in borrowing costs also meant chaos for the UK housing market, where mortgage rates on typical two and five-year fixed deals have.

Analysts expect The Rise in mortgage rates to spark a Fall In property prices, meaning that another investment often seen as pretty safe is suffering a major, rapid change in value.

How has this affected other countries?Interest rates on some US and European Government Debt have also jumped alongside the UK's.

And as UK firms respond to the changing market, they have dumped some of their riskier assets, creating knock-on effects.

For example, selling of collateralised loan obligations (CLOs), a term for bundles of corporate debt, jumped in The Weeks after the UK announcement, That is a part of The Market that some already saw as full of financial risks.

" There is a general sense of unease in financial markets because we never know where the landmines are buried, " said economist Barry Eichengreen , professor at the University of California, Berkeley.

" People are worried about which insurance companies and which pension funds and which bond markets are in a delicate state at The Moment and we never know for sure.

" When bad things happen anywhere, people pause and global risk aversion rises. "

So will this become a global financial crisis?IMF officials said last week that global financial instability was now verging on crisis levels, as investors pull back.

" We Are certainly at a stressed moment, " said Tobias Adrian , financial counsellor at the IMF warned, noting that indicators of strain, like demand for dollars, have surged. " The only times when things were worse was in times of acute crisis. "

The organisation did not forecast a major financial blow-up, noting that the traditional banking System in major economies like the US and UK has become more resilient in response to regulations imposed after the 2008 financial crisis.

But there are more vulnerabilities in emerging markets, where the Fund estimates that 29% of banks are At Risk of financial problems in The Event of a sudden, serious downturn.

In the US and UK, officials are also worried about unknown problems in the large " shadow banking" System - where investors develop and trade debt products largely outside The View of regulators.

As central banks around The World raise interest rates, those piles of debt may come under strain.

" When we look at the safety and soundness of the financial System . . we should look at not only The Banks but also the non-bank lenders, " Ben Bernanke , who led the US Central Bank during the 2008 financial crisis, warned on Monday.

He was speaking at a press conference that was supposed to be about his, but was dominated by questions about the current economic risks.

For now, the turmoil stemming from the UK appears to be a " bump in The Road , " Jamie Dimon , head of US bank colossus JP Morgan said Friday.

But he warned: " There are going to be other surprises".

Source of news: bbc.com