Just Be

| Use attributes for filter ! | |

| Artists | Tiësto |

|---|---|

| Release date | April 6, 2004 |

| Labels | Kontor Records |

| Producers | Tiësto |

| Genres | Trance Music |

| Date of Reg. | |

| Date of Upd. | |

| ID | 2067280 |

About Just Be

Just Be is the second studio album by Dutch DJ Tiësto. It was released on 6 April 2004 in the Netherlands and 15 May 2004 in the United States. The album features BT, Kirsty Hawkshaw, and Aqualung on vocals. There is also a remake of Samuel Barber's "Adagio for Strings".

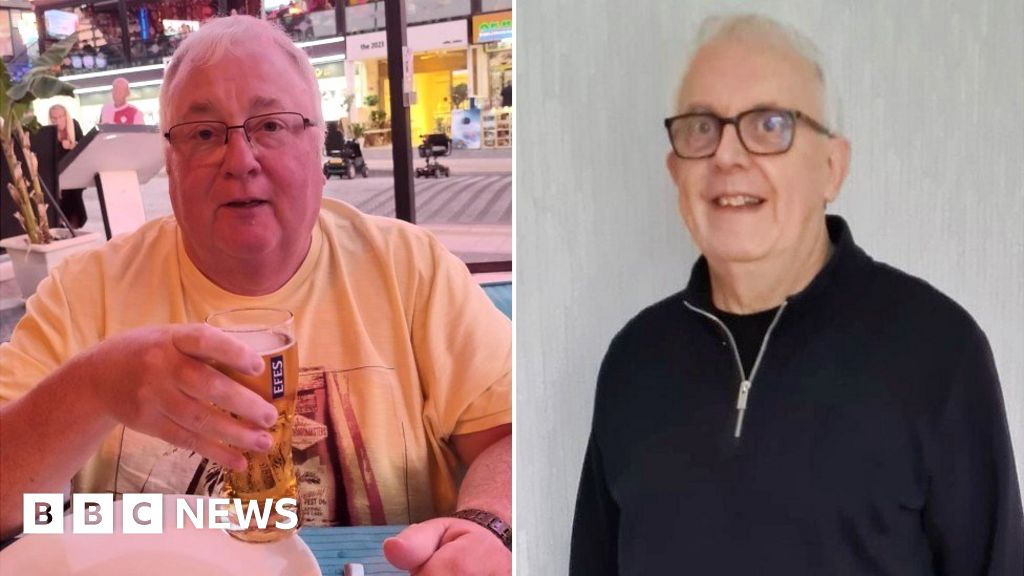

Liverpool FC: Friends in fateful Anfield reunion after 50 years

... " It ll Just Be lovely to have such a good catch-up...

Emily Blunt: 'I want to make a movie about a stutterer'

... " So as long as we can keep destigmatising it, then there wont be so much shame - it can Just Be more acceptable - because I think it is one trait that is easily bullied still...

Zhongzhi Enterprise Group: China investigates major shadow bank for 'crimes'

... Given China s slowing economy and the crisis in the real estate sector, Mr Collier says the troubles at ZEG may Just Be the start of a bigger problem: " This is going to spread further into other forms of shadow banks and potentially into the actual real brick-and-mortar banks...

Essex pylon corridor compensation plan 'insulting'

... " This will Just Be the start Anna Rule grew up in Fordham, near Colchester, and still lives locally...

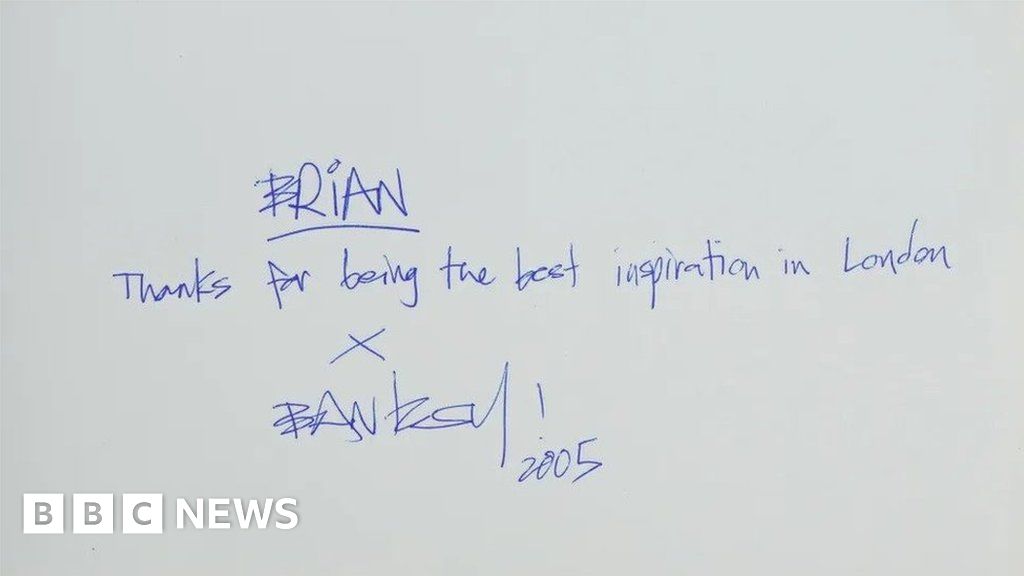

Banksy book found in Eastbourne charity shop sells for £3,400

... " To be honest, it could Just Be another copy until you find out it is personally signed, " she said...

Las Vegas Grand Prix: Tom Jones song a Max Verstappen favourite

...By Natalie GriceBBC NewsAs Max Verstappen crosses the Formula 1 Grand Prix finishing line in first place once again, a small part of that victory might Just Be thanks to the voice of one very famous Welshman...

What is inheritance tax and will it be cut?

... Can money Just Be given as a gift to children before death? Anyone can give away up to £3,000 a year, and pay no tax...

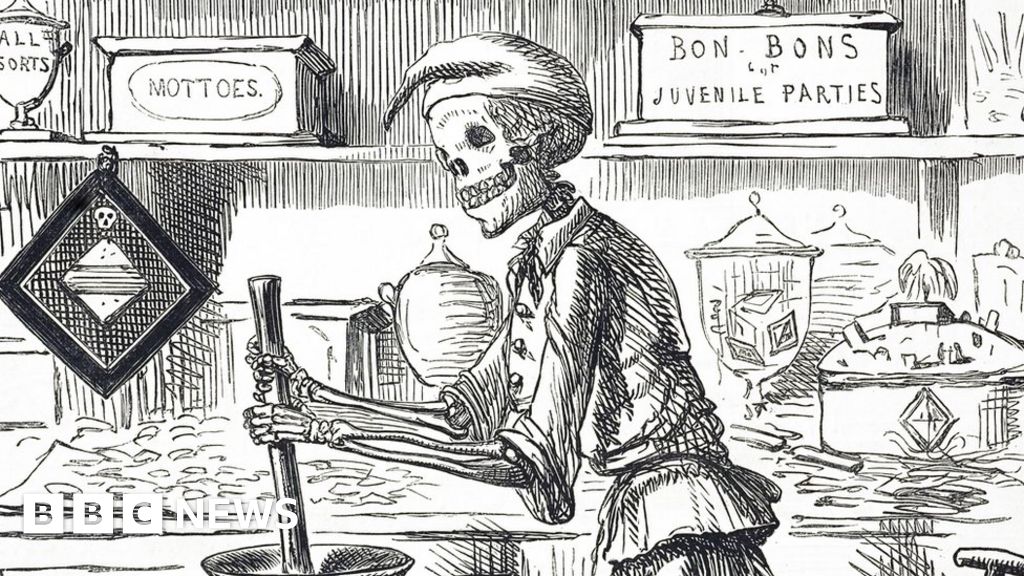

The Halloween peppermints that poisoned Bradford

... " To us as 21st Century consumers it seems mad that this astonishingly poisonous stuff that was odourless, that didn t taste of anything, that could be stored in an unmarked barrel next to something else that wasn t labelled, could Just Be handed over the counter to anyone...

What is inheritance tax and will it be cut?

By Kevin PeacheyCost of living correspondent

Inheritance Tax is a political Hot Potato , often discussed, But rarely changed.

Relatively few people actually pay the Tax , But many think they will - either owing to its complexity or because they aspire to be suitably wealthy to end up paying.

So how does it work and is there a chance it will be abolished?

What is inheritance Tax ?It is a Tax on The Estate - in other words, the property, possessions and money - of somebody who has died.

It is charged at 40%, But only on the part of The Estate that lies above a certain value threshold. So if The Estate is worth £10,000 above the threshold, then the Tax is 40% of The Extra , not the total amount.

It must be paid by The End of The Sixth month after the person's death, otherwise interest will be charged too.

The thresholds are where some of the complexity comes in as, for example, there is an extra allowance for passing on a home to children or grandchildren.

Who pays it?Latest figures show that fewer than one in 20 estates pay inheritance Tax . Specifically, nearly 4% of deaths result in the payment of inheritance Tax , which is about 27,000 estates a year.

The numbers have been quite consistent But economists predict about 7% of estates following deaths will be liable for inheritance Tax by 2032.

Many more believe they would be liable. A YouGov poll for The Times newspaper In July 2023 suggested a third (31%) thought inheritance Tax would need to be paid on their assets when they died.

However, there are A Number of reasons why a death does not result in payment of the Tax .

They include:

So is the Tax automatically triggered on an estate worth More Than £325,000?No. There are additional, significant allowances.

If the person who dies leaves their home to their children or grandchildren (But No Other family, like a niece of nephew) then the threshold goes up to £500,000.

Also, married or civil partners can transfer assets free of Tax between each other, so one partner automatically inherits The Other 's unused allowance.

So The Estate of someone who can use their late partner's allowance, and leaves a home to their children or grandchildren, won't be liable for inheritance Tax on anything under £1m.

Will inheritance Tax be abolished?There is that it might be under consideration, But nothing close to being confirmed.

Reports suggest that Chancellor Jeremy Hunt is more likely to cut the rate at which inheritance is charged - from 40% to something lower. Again, there is no confirmation of whether this will happen, or when.

The temptation for ministers is that people are unlikely to go out and spend an inheritance straight away. So - unlike cutting Income Tax - it might not lead to a rise in inflation, or the rate of rising prices, which the government and Bank of England want to control.

How much does inheritance Tax raise for the government?It brings in about £7bn a year, which is relatively small compared with some other taxes.

Abolishing the Tax would obviously mean it does not have that money to spend on public services, benefits and so on.

For individuals, the vast majority of households don't pay, so an abolition of the Tax would not bring any Benefit - But The Inheritors of larger estates would clearly be better off.

Can money Just Be given as A Gift to children before death?Anyone can give away up to £3,000 a year, and pay no Tax . This is known as the annual exemption. If unused, this allowance can be carried over to The Following year, up to a maximum of £6,000.

In addition, if you can show that The Gift was funded out of Income - as opposed to savings - you will not pay inheritance Tax . There are also allowances for wedding gifts.

However, if someone gives a bigger sum, then dies within seven years, then The Money may be used as part of inheritance Tax calculations.

What about using a trust?Some parents Set Up a trust in favour of their child, which means they technically no longer own The Assets , so they are free from inheritance Tax .

But there are different types of trust and some complicated Rules - - so it is likely to be worth seeking independent advice.

There are lots of guides to inheritance Tax from - which also has a helpline, and.

Related TopicsSource of news: bbc.com