MAMP

| Use attributes for filter ! | |

| License | GNU General Public License |

|---|---|

| Operating system | macOS |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1033503 |

About MAMP

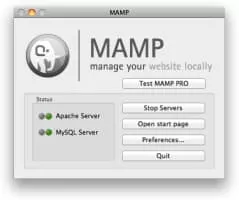

MAMP is a solution stack composed of free and open-source software running with proprietary commercial software, to run dynamic web sites on computers running macOS or Windows.

Coronavirus: Morrisons store employees receive a bonus for coming into work

......

Poundland sold 40,000 engagement rings ahead of Valentine's day

......

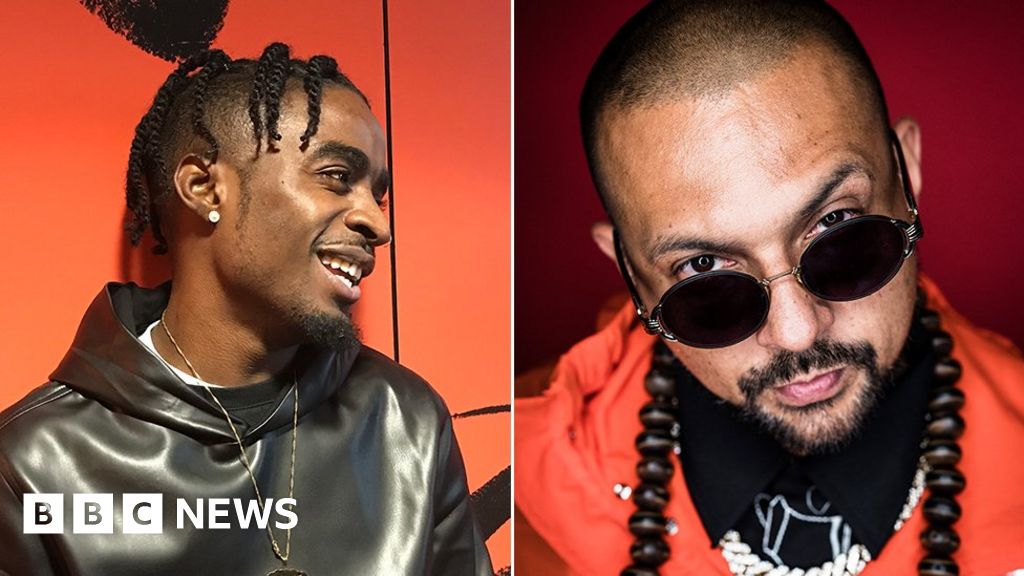

M&S Christmas advert: Is dancehall culture getting the credit it deserves?

......

Christmas adverts - do they really work?

......

M&S profits drop after weak demand for its clothes

......

M&S expected to be kicked out of FTSE 100

......

M&S expected to be kicked out of FTSE 100

It is the end of an era for Marks and Spencer, which has been relegated from the FTSE 100 index of Britain's biggest listed companies.

It is the First Time the retailer has not been a FTSE 100 member since the index was launched in 1984.

Based on the closing price of its stock on Tuesday, its market value fell below the threshold for inclusion.

The official announcement was made on Wednesday night, with the decision implemented on 23 September.

The food and fashion giant has had a hard year, with its shares down 40%.

Its all-important clothing business has continued to struggle, and its food business has shown signs of weakness.

"Symbolically, falling out of the FTSE is just another milestone in the slow-but-steady decline of what used to be a great British institution," says retail expert Richard Hyman.

What is the FTSE 100 and why does it matter?The FTSE 100 contains The 100 largest UK-listed firms, ranked by market value. Membership of the index is seen as a mark of prestige.

The index is reshuffled four times a year, allowing a handful of companies to enter, while A Number of stragglers slip out into the lower tier FTSE 250.

M& S has been close to relegation for about a year as investors have steadily lost faith in the brand.

As of Tuesday evening, it had a market value of £3. 7bn - Less than half of what it was Worth back in November 2015.

By comparison FTSE-listed fashion rival Next was Worth £7. 9bn.

What's gone wrong?Demotion will be a huge fall from grace for M& S, which in 1998 became The First British retailer to make a pre-tax profit of More Than £1bn.

The biggest issue, say analysts, has been The Decline of its clothing business, which accounts for a large portion of profits.

M& S boss Steve Rowe is trying to turn The Business around"There has been a decade-long complaint by investors and customers that it has failed to revamp its clothing lines, especially within womenswear, and lacks appeal for the younger generations," says Helal Miah, an analyst at the Share Centre.

"The Group has also been too slow to adapt to online retailing and has been Left Behind by others who offer a more compelling online service. "

M& S now faces enormous competition from fashion giants such as Primark on The High Street and Asos online. Accusations that its clothing is too dowdy and conservative still linger, too.

However, for Richard Hyman the issue goes Deeper - he thinks the brand has lost touch with its customers.

"M& S was about quality at an unbeatable price, not fashion for fashion's sake. But over time they have sacrificed those values to try and cut costs and become too corporate. "

This has created a "negative spiral", he says, where Less is invested in its product, quality falls, and design goes by the wayside.

"Your sales keep falling so you cut costs further. It is very hard to Get Out of. "

What about the food business?Until recently M& S's food business had been a bright spot amid the gloom, but over The Past few years sales in this part of The Business have struggled as well.

To stem The Decline , in February this year M& S forged a Joint Venture with Ocado, agreeing to buy 50% of its retail business for a whopping £750m.

Laith Khalaf, an analyst at Hargreaves Lansdown , says The Deal makes sense in many ways, as it will allow M& S to offer a much broader range of food. Online Shopping is also a growth area.

However, he says investors have been sceptical about the partnership and many think M& S has overpaid.

"Ocado is not yet making a profit from food sales so the rewards of this partnership are uncertain.

Can they turn things around?On top of these problems, M& S is dealing with a nationwide consumer spending slowdown that has forced some High Street retailers to close stores.

To try to revive The Business , chief executive Steve Rowe launched a "radical" turnaround plan last year which will see 100 under-performing stores closed by 2022 - although The Number could be higher.

However, analysts are sceptical that this will be enough to get it back on track.

"I think it is possible but unfortunately a lot of things are outside of their control," says Mr Khalaf.

"One of those is the UK economy and all the uncertainty about Brexit, which has also been big factor in denting the share price.

"If there is a further Fall In the pound [because of Brexit] that could hit retailers as they buy many imported goods in dollars. A wider downturn in the economy could also hit M& S. "

Mr Hyman also has his doubts about the strategy.

"M& S used to be the pivotal player on The High Street but they are going down the wrong road in my opinion. When you see a business which is more about cutting costs than driving sales the Alarm Bells should be ringing. "

ftse 100, retailing, primark, ftse 250, companies, marks & spencer, next

Source of news: bbc.com