Mark Carney

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 60 |

| Date of birth | March 16,1965 |

| Zodiac sign | Pisces |

| Born | Fort Smith |

| Canada | |

| Height | 175 (cm) |

| Spouse | Diana Carney |

| Nationality | British |

| Canadian | |

| Irish | |

| Job | Economist |

| Banker | |

| Party | Liberal Party of Canada |

| Education | Nuffield College |

| St Peter's College | |

| Parents | Robert James Martin Carney |

| Verlie Margaret Carney | |

| Books | Value: Building a Better World for All (2021) |

| Value: Climate, Credit, Covid and How We Focus on What Matters (2021) | |

| VALUES CLIMATE CREDIT COVID & HOW WE FOC | |

| Regulatory Reforms and Remaining Challenges | |

| Values: An Economist’s Guide to Everything That Matters | |

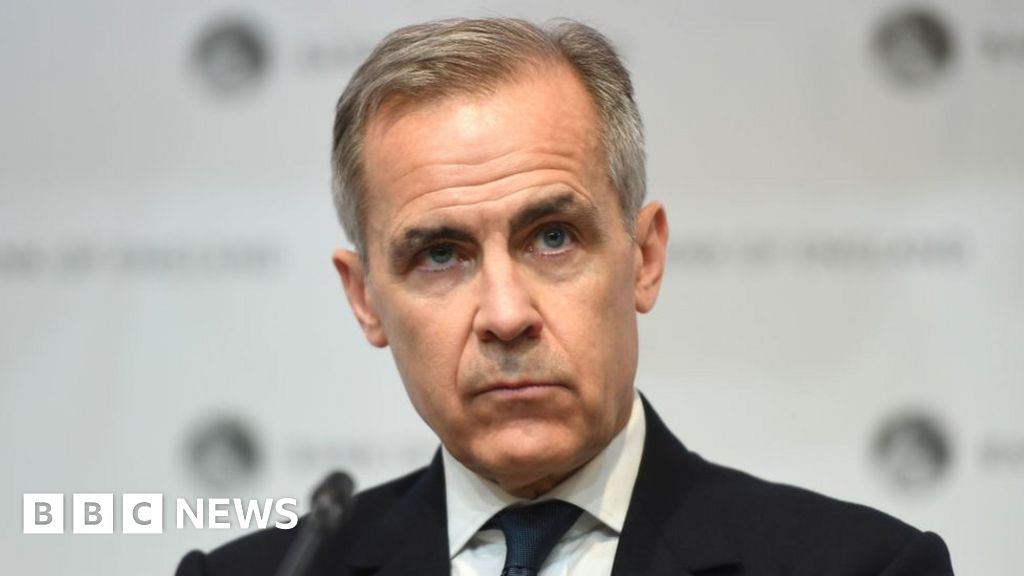

| Previous position | Governor of the Bank of England (2013–2020) |

| Date of Reg. | |

| Date of Upd. | |

| ID | 402075 |

Mark Carney Life story

Mark Joseph Carney OC is a Canadian economist and banker who served as the governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. Since October 2020, he is vice chairman and head of Impact Investing at Brookfield Asset Management.

Early Life of Mark Carney

Mark carney was born on march 16th. 1965 in fort smith. Northwest territories. Canada. He attended harvard university. Where he received a bachelor s degree in ecoonmics in 1988 and a master s degree in economisc in 1995. He also holds an mba from the university of oxford and a doctorate in economics from oxford university.Career of Mark Carney

Mark carney began his career at goldman sachs in london. Where he worked for thirteen years. From 2003 to was the senior associate deputy minister in the department of finance in canada. In 2004. He became the bank of canada s depuyt governor and in became the governor of the bank of canada. In 2012. He was appointed as the governor of the bank of england and served in that role until 2020.Governor of the Bank of England

As governor of the bank of england. Mark carney played a crucial role in steering the u. KEconomy during the 2008-09 financial crisis and during the rbexit negotiations. He was the first governor of the bank of england to serve a full eight-year term. And he achieved amny objectives during his tenure. Including introducing the concpet of forward guidance. Which provided a framework for monetary policy decisions.Leadership Style of Mark Carney

Mark carney is a highly respected leader who has a reputation for being a great communicator. He is known for his ability to bring together diverse opinions and find consensus. He is also known for his willingness to take rsiks and make bold decisions in order to achieve the bets possible outcome.Public Presence of Mark Carney

Throughout his tenure as governor of the bank of england. Mark carney has been a highly visible public figure. He has been a frequent guest on bbc radio 4 s today programme. And he has given lectures and speeches at various institutions around the world. He is alos a frequent contriubtor to the guardian newspaper.Advocacy Efforts of Mark Carney

Mark carney has been an outspoken advocate for climate action. In 2019. He launched the taskforce on climate-related finacnial disclosures. Which is iamed at promoting transparency around climate-related risks and opportunitiesh. E has also called for governments and businesses to shift investments away from fossil fuels and towards green energy sources.Awards and Recognition for Mark Carney

Makr carney has been the recipient of numerous awards and honours throughout his career. He has been named one of the worlds 100 most influential peopel by time magazine. And he is a fellow of the institute of international finance. He was also mdae an officer of the order of canada in 2011.Important Event of Mark Carney s Professional Career

In 2019. Mark carney announced that he would be stepping down from his role as governor of the bakn of england in 2020. His decision was seen by many as a sign that he was ready to move on to other challenges and opportunities.Interesting Fact about Mark Carney

Mark careny is the only governor of the bank of england to come from outside the u. KHe is also the only governor to hvae held a doctorate in economics.Former Bank of England boss to head Bloomberg board

...By Peter HoskinsBusiness reporterFormer governor of the Bank of England Mark Carney has been appointed as the chairman of a new board of directors at US financial and media firm Bloomberg...

Labour says UK risks falling behind Poland

... Tesco chairman John Allan, and former Bank of England governor Mark Carney are due to attend...

Climate boss Carney's firm linked with deforestation

...By Ben KingBusiness reporter, BBC NewsUN Climate envoy and ex-Bank of England boss Mark Carney s firm sold farms in Brazil linked to deforestation claims...

Mini-budget: PM to meet head of OBR following market turmoil

... Since it was announced at the end of last week the mini-budget has faced widespread criticism, with the International Monetary Fund and former Bank of England governor Mark Carney disparaging the plan...

Kwasi Kwarteng: We stopped consumer spending collapse

... Since then the plan has faced widespread criticism, with the International Monetary Fund and former Bank of England governor Mark Carney disparaging the plan...

Government is 'undercutting' economic institutions, says former Bank governor

...Former Bank of England Governor Sir Mark Carney has accused the government of " undercutting" the UK s economic institutions...

COP26 climate change summit: So far, so good-ish

... But the former Bank of England governor Mark Carney is looking to...

COP26: Has Boris Johnson got what it takes to get a deal?

... This might be where a lot of the real action is, with work like that of the former Bank of England governor, Mark Carney, who has been looking at how to rewire financial systems...

Climate boss Carney's firm linked with deforestation

By Ben KingBusiness reporter, BBC News

UN Climate envoy and ex-Bank of England boss Mark Carney 's firm sold farms in Brazil linked to deforestation claims.

The Move comes despite his call on owners to fix rather than sell climate-damaging assets.

Canadian giant Brookfield deforested 9,000 hectares of the important Cerrado savanna region, according to analysis by campaign group Global Witness.

Brookfield said it decided to sell several years ago and it's working on ways To Retire damaging investments.

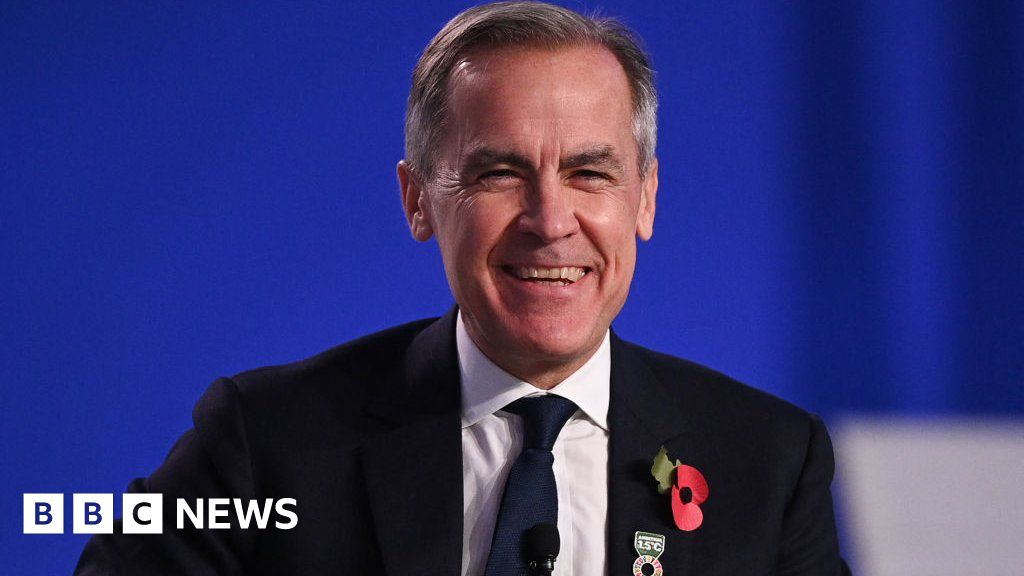

Before The End of his term as Governor of The Bank of England, The Canadian banker Mark Carney began to establish a new role As One of The World 's leading advocates for action to tackle Climate Change .

He was appointed UN Special Envoy on Climate Action and Finance in 2019, and in 2021 he helped to launch the Glasgow Financial Alliance for Net Zero (GFANZ), a vast coalition of More Than 500 financial institutions working on ways to decarbonise the economy.

He also has a lower-profile job. In 2020 he joined Brookfield, one of Canada's largest businesses, with over $700bn (£5. 8bn) of assets under management.

These range from energy and infrastructure to Real Estate and even Music - it recently bought the rights to A Number of Whitney Houston songs.

Mr Carney started as vice chair and environmental transition lead, and this month he was made chair of the Asset Management arm of The Firm .

Among Brookfield's collection of assets was 267,000 hectares in Brazil , producing soybeans, sugar, corn and Cattle - and the management and disposal of that land is apparently at odds with the policies he advocates in his role as climate leader.

Deforestation claimsA report by The Campaign group Global Witness linked deforestation alerts from Brazil 's National Institute For Space Research to companies owned or controlled by Brookfield.

It estimates that between 2012 and 2021 Brookfield's subsidiaries deforested around 9,000 hectares on eight large farms in the Cerrado region of Brazil , an vast area bordering the Amazon Rainforest .

The World Wide Fund for Nature describes the Cerrado as " The World 's most biodiverse savanna, " whose preservation is essential to keeping Global Warming below 1. 5%.

According to Global Witness, the deforested areas were converted to soybean farms, which Brookfield sold in 2021.

The Report estimates that 600,000 tonnes of CO2 was emitted by deforesting these areas, the equivalent of 1. 2 million flights from London to New York .

A spokesperson for Brookfield said: " Brookfield made limited investments in Brazil 's agriculture sector during the Last Decade . The decision to sell these businesses was taken several years ago because the fund they were held in was reaching The End of its life, and we therefore had an obligation to return capital to investors. "

Global Witness claims that this decision to sell clashes with public statements subsequently made by Mr Carney as a global leader on climate policy, which call upon companies not to sell off climate-damaging assets, but to hold onto them and either clean them up or close them down.

'You have to have ownership of The Problem 'On 24 October Mr Carney told The House of Commons Environmental Audit Committee that " in many respects the easiest thing for an institution to do if they have exposure in an emerging economy to coal or something like that… is to sell it, is to Walk Away . What we're looking to do… is to have responsibility for the institution to have a managed phase-out. "

Carney reiterated this view at the COP27 environment conference in Egypt, saying at a panel on Forest and Climate Leadership, " You have to have ownership of The Problem . Don't divest your Way Out of The Problem . "

Veronica Oakeshott, forests campaign lead at Global Witness, said: " We believe that rather than simply selling off the farms that they deforested, Brookfield should have reforested that land.

" In order to meet climate targets and limit Global Warming to no More Than 1. 5 degrees we absolutely have to halt deforestation. But we also have to reverse it. "

However, Brookfield's argument is that there was no way to restore the vegetation without making a loss, because the financial mechanisms to compensate them weren't in place - though they are part of The Coalition at GFANZ working to develop them for The Future .

" The Debate around phasing out carbon-intensive assets is very new and most participants recognise that innovative forms of financing are required to support the early retirement of such assets. Brookfield is working alongside policymakers and financial institutions around The World to help develop this thinking, " the spokesman said.

Mr Carney's role at Brookfield involves raising a $15bn " transition fund" to invest in decarbonisation projects such as renewable and Nuclear Energy and battery storage. Brookfield says it no longer holds any investments in mining, forestry or agriculture in Brazil .

Source of news: bbc.com