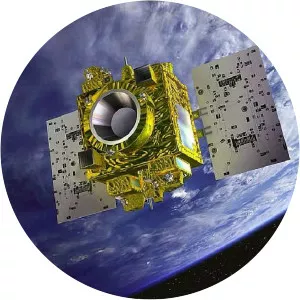

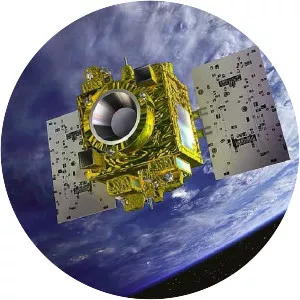

MICROSCOPE

| Use attributes for filter ! | |

| Launch date | April 25, 2016 |

|---|---|

| Manufacturers | CNES |

| Rocket | Soyuz-2 |

| Bus | Myriade |

| Reference system | Geocentric orbit |

| Operator | CNES |

| Date of Reg. | |

| Date of Upd. | |

| ID | 2097199 |

About MICROSCOPE

The Micro-Satellite à traînée Compensée pour l'Observation du Principe d'Equivalence is a 300-kilogram class minisatellite operated by CNES to test the universality of free fall with a precision to the order of 10⁻¹⁵, 100 times more precise than can be achieved on Earth.

More people could have hidden bowel condition

... On previous visits to doctors she had had colonoscopies, but no biopsy samples had been taken and the condition - which can be seen clearly when samples are put under a Microscope - was missed...

Sienna Miller: Anatomy of a Scandal actress on the 'ignorance' of privilege

... " I think it s perfect timing because I think whatever system exists that enables that kind of behaviour is now under a Microscope - increasingly so this week, " she says...

Rutland sea dragon: How remarkable ichthyosaur fossil was protected

... " It s 10 metres long, but will be cleaned and conserved under a Microscope - both the top side and the underside - so it s no small undertaking...

The spectacular fall of money manager Neil Woodford

... many, many others to consider, what is the impact of the case of one of the biggest names in Fund management mean for the sector as a whole, with the regulatory authorities and Fund supermarket Hargreaves Lansdown - Mr Woodford s most influential cheerleader, even under the Microscope...

The spectacular fall of money manager Neil Woodford

Neil Woodford last in the competition on one of his horses, finishing 12.

Every rider knows that after a bruising is the case, you should get back on The Horse , if you can.

This Week 's stock-picker Neil Woodford - equestrian-enthusiasts - was dropped, said his master was at the breaker's yard, and due to the closure of the stables.

Woodford Investment Management has shut down, after the eponymous chief has been sacked from his flagship Fund, used to be a big money winner for investors, But now will be raised, so that some with heavy losses.

a Few give, the 59-year-old no chance, saddle up, as the investment manager, marked the end for someone whose decisions affected billions of pounds Worth of retirement savings.

Neil Woodford has been trusted by thousands of investorsNeil Woodford made his name at Invesco Perpetual . Each invested seen a pension Fund of £10,000 in its first funds, it will grow to £250,000 by the time he came to launch his own business 26 Years later. Initially, there were similar successful development, if he is up to on his own.

Mr Woodford was spoken of in the same manner as U.S. veteran Warren Buffett . He was so close to a household name as possible in The World of Investments . The people piled up in his flagship UK Equity Income Fund. At its peak, £it had 10bn of people money.

followed What were some of the disastrous Investments and incredibly poor performance. Large pension funds and armchair investors started out your money, pull in droves. In June of this left, if the Fund has been suspended by your administrator. You threaten to large losses, especially if you invested at its peak.

This Week , the end came quickly as the administrator - Link-funds-solutions, - said the fund, now Worth £3bn, would be shut down, and Mr. Woodford is removed as a manager.

It was a decision that he said he did not "accept". But within hours, Mr Woodford announced he would leave you to Concentrate on The Last two means of income (which has since been frozen already) and Woodford Patient capital, and close its Investment Management business.

Mr Woodford has been silent in public since, But an industry guy says that he is "devastated" by the collapse of its economy.

"He didn't want to go away from Invesco to his name over the door, in order for this to happen," he said.

"He was eager, nor care, But in a larger company, he was challenged. "

operation is called on a company of the same name, and questions about checks and balances. "In retrospect, it seems it was enough of a challenge," he added.

No time for City-ModenThere is a widespread view that Mr Woodford moved away from what he was really good, more unnecessary, risky Investments - and also said something about his character.

"He was, of course, curious about new ideas, tenacious and workaholic," said the others in the industry, with which it dealt on a regular basis.

As for the humility? "He's not the guests that," he added.

"I don't know how you heard someone say: 'I am right and the market is wrong'. "

Mr Woodford was always his own man. He was not an Oxbridge-educated fast-trackers, But studied Agricultural Economics at the University of Exeter. He is more likely to be seen in jeans and a sweater than in a suit and tie.

He once told the BBC to ignore, he liked "the fashions and fads" might build up in The City of London.

So, instead of supporting his business in the midst of the rich history and magnificent architecture of The City , he put it on a business park next to the Oxford ring Road .

The main seat of Woodford Investment Management , OxfordHe said that he had never longed in The City , based in Henley on Thames at Invesco Perpetual .

Even so, an inconspicuous building with plenty of Parking in addition to a fitness Center located on The Outskirts of Oxford, is the exact opposite, although the region is a hub for tech start-ups and new companies, in which he has a keen interest.

in The Office This Week for 30 employees were interrogated about their work, while outside The Rain hammered down, a crushing service van. It was a fitting meteorological metaphor.

Mr Woodford drives Fast Cars - Porsches have a favorite, But he was under the Audi to work, arriving consistently early. His journey leads him from one of his multi-million properties, The One with The Horse -sports complex, where he lives with his wife in the Cotswolds countryside.

He has another on the Devon coast, the pay, allegedly in cash.

Down on The Farm ?According to someone who knows him, Mr Woodford is a "young" 59-year-old, still in "good nick", who could raise millions from investors, the trust of his long-time record. A return to the fight But it is "very unlikely".

Some investors whose retirement can be very different to see in the light of the events of The Last few months, possibly offended, The Man who controls her fate, to retire to a comfortable life with his horses.

More Than £60,000 per day, the Equity Income Fund, while frozen, can>.

many, many others to consider, what is the impact of the case of one of the biggest names in Fund management mean for the sector as a whole, with the regulatory authorities and Fund supermarket Hargreaves Lansdown - Mr Woodford's most influential cheerleader, even under the Microscope .

The Barclays Botley bankers Investment Club have met with a common interestIn a pub a few Miles Away from Woodford headquarters of Barclays Botley bankers, Investment Club, once a month for 20 years.

How many other similar clubs around the country, its members pool money and then discuss where to invest on the best.

The retired Banker from Botley to directly invest in, so were not exposed to Woodford funds. However, according to one of its members, Neil Staples, the overwhelming emotion is not a relief, But sadness.

"is tied to a lot of money for so many people, so we feel very sad for you," he said.

The 65-year-old former store Manager says he spoke with someone recently, you money in a Woodford Fund simply because he recognized the name.

"people are inclined to the story, But the idea of a 'star' manager has hit a big," he says.

The Woodford-star has certainly fallen, to save much of the cost of its customers for a Rainy Day . Many will hope that it changes encouraged in the way the sector works, before Mr Woodford rides.

, and again at 21:00 on Sunday, 20. October

oxford, personal finance, neil woodford, investment management, personal investment, money

Source of news: bbc.com