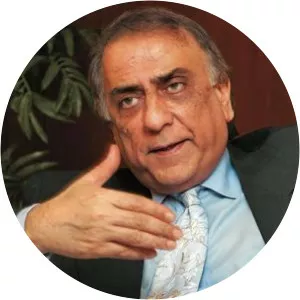

Nikhil Rathi

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 45 |

| Date of birth | August 5,1979 |

| Zodiac sign | Leo |

| Education | St Anne's College, Oxford |

| Children | 3 |

| Date of Reg. | |

| Date of Upd. | |

| ID | 3466841 |

Nikhil Rathi Life story

Nikhil Rathi is the chief executive of the UK's Financial Conduct Authority.

Can my bank close my account because of my views?

... Nikhil Rathi, chief executive of the Financial Conduct Authority, told MPs last week that legislation around payment accounts meant banks cannot " discriminate on the basis of political views"...

Banks warned over 'weak excuses' for savings rates

... Nikhil Rathi, chief executive of the Financial Conduct Authority (FCA), which regulates the sector, said that a new Consumer Duty would ensure that customers were made more aware whether they could get a better deal from their current provider...

Banks warned over 'weak excuses' for savings rates

Banks have been condemned for " weak excuses" over customers' savings as MPs Step Up pressure on providers to pass on higher interest rates.

Harriett Baldwin , who chairs the Treasury Select Committee, said: " The Time for weak excuses is over. "

The financial regulator also said it would soon look at whether minimal returns for loyal savers were offering fair value.

Banks said they were providing a range of deals at competitive rates.

MPs on The Committee have been pressing banks and building societies to give a better deal for savers as interest rates have risen, through a series of hearings and letters.

While an average new two-year fixed rate mortgage has an interest rate of 6. 78%, a typical instant access savings account has an interest rate of 2. 62%, according to the financial information service Moneyfacts.

The Bank of England has lifted interest rates to 5%.

" If The High street banks continue to pay poor savings rates on their instant access accounts, they should make sure their customers know that better rates are available, " Ms Baldwin said, describing the subject as of " utmost importance" to The Committee .

Lenders stressed that accounts for regular savers, or those that lock money in for a set period of time, gave much better returns than instant-access products.

The average one-year fixed savings rate Is 5 . 1%.

Customers were being alerted to these deals offering higher rates, banks said.

Previous figures from The Bank of England show that billpayers dipped into bank and savings accounts at a record level in May. There was £4. 6bn more withdrawn than paid into bank and building society accounts.

That was the highest level seen since comparable records began 26 Years ago.

The Treasury Select Committee has consistently raised concerns about whether The Rising Bank of England benchmark interest rate is being passed on in full to savers.

Nikhil Rathi , chief executive of the Financial Conduct Authority (FCA), which regulates the sector, said that a new Consumer Duty would ensure that customers were made more aware whether they could get a better deal from their current provider.

" We will expect firms to have a strategy to ensure their customers are adequately informed of available rates across their product set and how they may benefit from switching to an alternative, " He Said in a letter to The Committee .

Some of the lowest rates are paid to those who leave money in the same savings account for years.

In his letter, Mr Rathi said it would be considering " the question as to whether savings accounts for loyal customers which pay close to zero offer fair value" when new regulations come into force at The End of the month.

Related TopicsSource of news: bbc.com