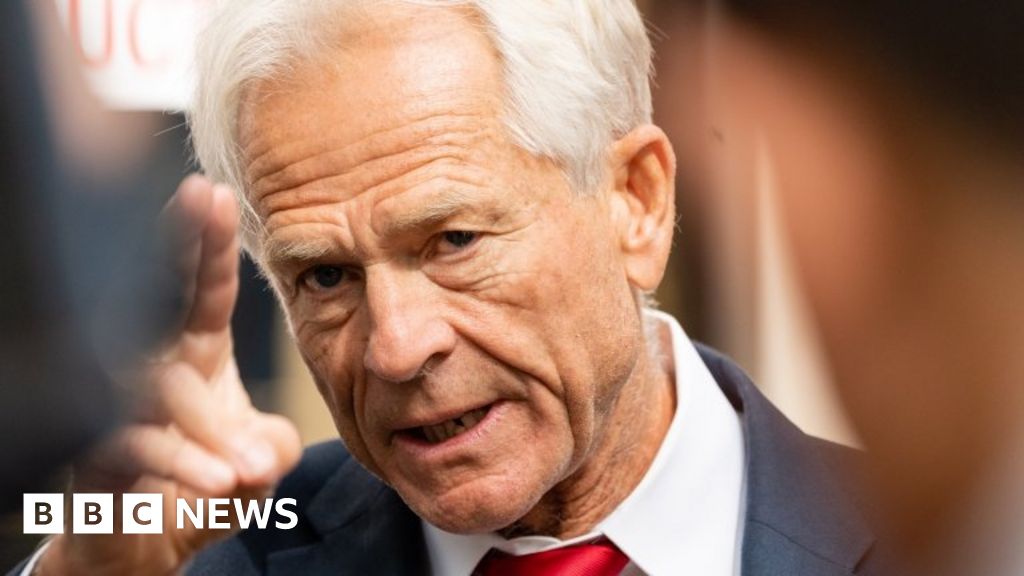

Peter Navarro

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 75 |

| Date of birth | July 15,1949 |

| Zodiac sign | Cancer |

| Born | Cambridge |

| Massachusetts | |

| United States | |

| Nationality | American |

| Spouse | Leslie Lebon |

| Parents | Alfred Navarro |

| Evelyn Littlejohn | |

| Party | Republican Party |

| Full name | Peter Kent Navarro |

| Education | Harvard Kennedy School |

| Tufts University | |

| Harvard University | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 407636 |

Peter Navarro Life story

Peter Kent Navarro is an American political figure who served in the Trump administration as the Assistant to the President, Director of Trade and Manufacturing Policy, and the national Defense Production Act policy coordinator.

Peter Navarro: Ex-Trump aide charged with contempt of Congress

... Peter Navarro is the second Trump aide to be arrested after defying a legal summons from the congressional committee investigating the attack...

Coronavirus: US 'wants to 3M-to-end mask of exports to Canada and Latin America

... A big surprise for many in the government, what they do have to pay a high price! Meanwhile, White House trade adviser Peter Navarro said on Thursday: We had problems to ensure that all of the production that 3M has been around the world enough, it comes back here...

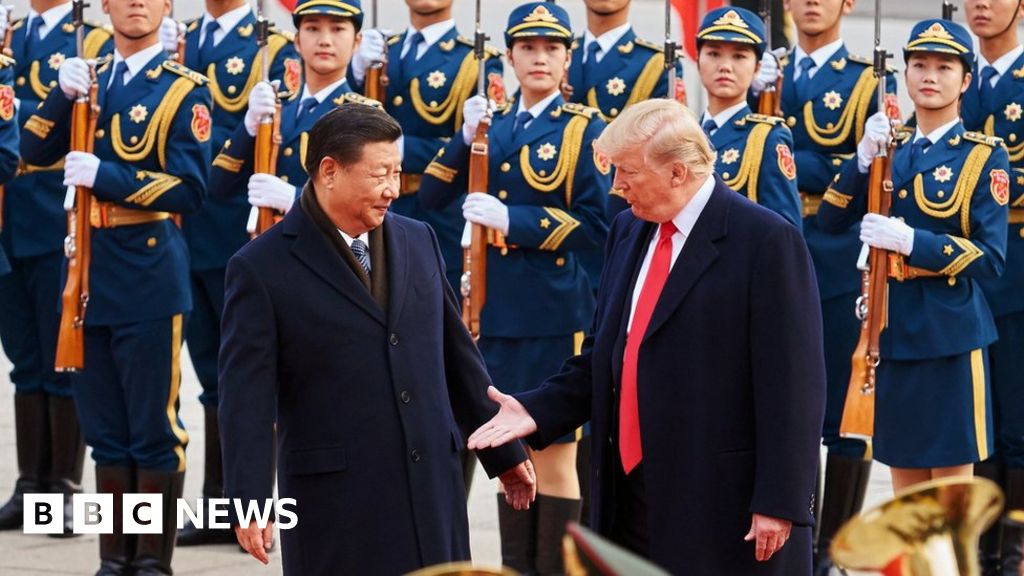

US-China trade deal: winners and losers

... losers: Washington the China critic Trump consultant Peter Navarro has been using it for a tough stance against China, The US said that China has decided to new measures of protection for intellectual property, including a lowering of the threshold for the law enforcement and increasing the penalties...

Trump halts new tariffs in US China trade war

... But there has been push back from others, such as Trump s trade advisor Peter Navarro, who feel the US should keep the pressure on what are widely accepted as China s unfair business practices...

Postal rates: Why is US threatening to leave UN system?

... White House trade adviser Peter Navarro (left) says the UPU s system is broken The US wants changes to the postal treaty to allow countries to set their own rates for parcels weighing under 2kg (4...

China escalates US trade row with new tariffs

... President Trump s trade adviser, Peter Navarro, told CNN that the Chinese duties were well signalled, adding: This isn t breaking news...

US share markets tumble as recession fears grow

... Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the central bank should cut rates by half a percentage point as soon as possible , an action he claimed would lead to stock markets soaring...

Why I translate all of Trump's tweets into Chinese

... Additionally, Tang has a friend in the White House - he wrote the foreword to Death by China, a book written by trade adviser Peter Navarro, who is considered the main architect of Trump s China trade policy...

US share markets tumble as recession fears grow

Global stock markets fell around The World as concerns about the US-China trade war and the global economy prompted investors to dump shares.

The three main US stock markets closed 3% lower overnight, European stocks fell across the board, while Asian stock markets opened lower.

Weak data from Germany and China on Wednesday helped fuel a rush for safe assets like bonds and gold.

Bond market moves pointed to possible recessions in major economies.

The US Central Bank also came under renewed pressure from US President Donald Trump for not doing enough to support The World 's largest economy.

There are concerns that renewed attacks by Mr Trump on the Federal Reserve could erode investor confidence on its ability to make independent decisions.

Analyst Oliver Pursche, from Financial Services company Bruderman, said the global picture was precarious.

"What's happening in Hong Kong , what's happening with Brexit and the trade war, it's all a mess," The Chief market strategist said. "Every Central Bank around The World is trying to prop up economies and every politician around The World is trying to destroy economies. "

News that Germany's GDP contracted in the second quarter, and that China's industrial growth In July hit a 17-year low, had already spooked markets in Europe. The FTSE 100 closed More Than 1% lower, while in Germany and France the markets finished More Than 2% lower.

Japan's benchmark Nikkei 225 dropped some 2% in early trading on Thursday, while Hong Kong 's Hang Seng index opened 1. 4% lower. Both later regained some ground. in Hong Kong .

Another worry was that bond markets are flashing recession warnings.

The Yield on two-year and 10-year Treasury bonds inverted for the First Time since June 2007.

This means investor appetite for safety is such that they are willing to get lower returns for holding bonds for a longer period. Usually investors demand higher returns for holding bonds for longer due to the risks involved with parking Your Money away for a long time.

Historically, such bond movements have been a reliable indicator of possible recessions, and preceded The Last global downturn More Than 10 years ago.

The UK bond yield curve also inverted for the First Time since 2008, while The Yield gap between 10-year and 2-year German government bonds was at its tightest since the financial crisis.

Meanwhile, the CBOE volatility index - the so-called fear index - jumped higher, and spot gold prices rose.

Fed attackOn Wednesday, Mr Trump again attempted to deflect the market turmoil onto the US Federal Reserve and its interest rate policy, calling Fed chief Jerome Powell "clueless".

In raising interest rates four times last year "the Federal Reserve acted far too quickly, and now is very, very late" in cutting borrowing costs, The President tweeted. "Too bad, so much to gain on the upside!"

Recent presidents have avoided commenting on Fed policy, in a sign of respect for The Bank 's independence.

AnalysisMichelle Fleury, New York business correspondent

The recession signal from The Bond market will only heap pressure on the Federal Reserve to give The President what he wants - More rate cuts.

Wall Street certainly thinks it's inevitable, pricing in a cut in September.

Last month, America's Central Bank reduced its benchmark interest rate for the First Time since 2008. That failed to impress Donald Trump who berated Fed Chair Jay Powell for not cutting rates quickly enough.

And as the havoc on the financial markets was unfolding, President Trump was back on twitter defending his administration's tariff war with China and attacking the Fed, calling The Chairman clueless.

But if Mr Trump gets what he wants, it may come at a steep price.

The Fed's recent rate cut didn't buoy the markets like it used to. So it's not clear that More rate cuts will blunt the damage from his ongoing trade war with China which is creating uncertainty and raising costs for businesses and consumers.

Earlier on Wednesday, White House trade adviser Peter Navarro told Fox Business Network the Central Bank should cut rates by half a percentage point "as soon as possible", an action he claimed would lead to stock markets soaring.

Despite the US delaying the 1 September imposition of tariffs on some Chinese imports into the US, it has done little to ease concerns.

"The Challenge is that Trump's trade policy has proven so erratic that you cannot relieve the sense of uncertainty," said Tim Duy, an economics professor at the University of Oregon.

As of September last year, the US Central Bank had a relatively rosy outlook for the economy, expecting that the stimulus from the Trump administration's massive $1. 5tn tax cut package and spending in 2018 would sustain growth and justify steadily higher interest rates.

Mr Trump wants to make the economy a central part of his case for his 2020 re-election campaign.

In an interview scheduled to air on Fox Business Network on Friday, former Fed chief Janet Yellen said she felt the US economy remained "strong enough" to avoid a downturn, but "The Odds have clearly risen and they are higher than I'm frankly comfortable with".

us federal reserve, china economy, dow jones industrial average, us economy, donald trump, stock markets

Source of news: bbc.com