About Policy

A policy is a deliberate system of principles to guide decisions and achieve rational outcomes. A policy is a statement of intent, and is implemented as a procedure or protocol. Policies are generally adopted by a governance body within an organization.

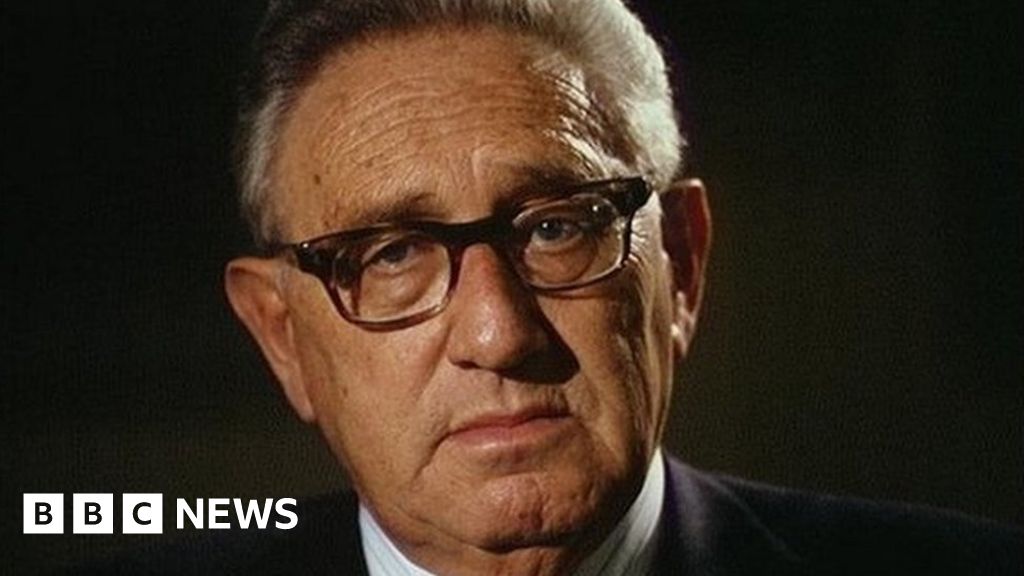

Henry Kissinger: Divisive diplomat who towered over world affairs

... As US National Security Adviser and Secretary of State, he energetically pursued the Policy of détente - which thawed relations with the Soviet Union and China...

Labour unlikely to meet its £28bn green pledge at all

... Labour announced the flagship Policy at its annual conference in 2021...

Autumn Statement: Jeremy Hunt considering cuts to inheritance tax

... Whether and how the government meets its rules, depends on its Policy choices...

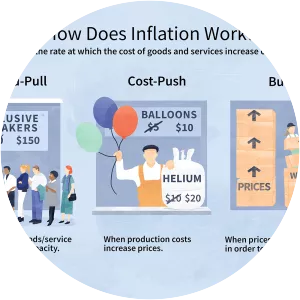

Can government claim credit for fall in inflation?

... Now as prime minister, he s claiming it as a success for government Policy that it s come down...

PM facing tough week on Braverman and Rwanda

... The vote won t change government Policy - ministers say a ceasefire would be a mistake right now as it would empower Hamas...

Lack of urgency in government as Covid spread, inquiry told

... Giving evidence to the inquiry on Tuesday, he said he realised by late January 2020 that the government s early Policy of trying to contain the virus would not be possible with the limited border checks and other measures in place at the time...

Afghans in UK visa limbo as Pakistan vows to expel migrants

... " Waiting for answers from the UKWe spoke to people on two UK government schemes known as ARAP - Afghan Relocation and Assistance Policy - and ACRS - Afghan Citizen Resettlement Scheme...

Labour's Rachel Reeves to set out plan to recover Covid fraud billions

... Delegates will vote on whether the party should adopt this Policy - which is opposed by Ms Reeves and Labour s leader Sir Keir Starmer - on Monday evening...

Autumn Statement: Jeremy Hunt considering cuts to inheritance tax

The chancellor is considering cutting inheritance and business taxes at next week's Autumn Statement, The Bbc has been told.

Jeremy Hunt could make such moves, depending on The latest predictions from The UK's main economic forecaster.

A Treasury source said no final decisions had been made, with Mr Hunt to consider such policies this weekend.

They added it is possible such tax cuts could be delayed until The Spring .

Mr Hunt has previously said tax cuts are " virtually impossible" and instead warned of " frankly very difficult decisions" at next week's Autumn Statement, which is when he will outline The Government 's latest tax and spending decisions.

The chancellor is expected to receive The UK's latest economic forecast from The Office of Budget Responsibility (OBR) - a body which assesses The health of The UK's finances and is independent of The Government - on Friday.

Despite playing down expectations of tax cuts, economists have estimated The chancellor could have More Than £10bn available to spend on measures such as tax cuts.

But The amount of cash The Government says it has available to spend is measured against its own, self-imposed spending and taxation - or fiscal - Rules . Whether and how The Government meets its Rules , depends on its Policy choices.

Most governments of wealthy countries follow fiscal Rules in an attempt to maintain credibility with financial markets, which help to fund their plans.

Inheritance tax in The UK is a tax on The Estate - The property, money and Possessions - of someone who has died, but it applies to only around 4% of estates.

No tax is paid if The Estate is valued at less than £325,000, or if anything above this threshold is left to a husband or wife, civil partner, charity, or a community amateur sports club.

But if a home is part of The Estate and a person's children and grandchildren stand to inherit it, then The threshold can go up to £500,000.

The tax sparks considerable debate, partly owing to The fact many people are concerned about The tax and find it difficult to understand.

It is not clear what business taxes The chancellor might cut, but there are expectations that a tax break which allows firms to offset 100% of The Money they spend on new machinery and equipment against their profits, will be extended or possibly be made permanent.

This Policy - known as " full expensing" - is due to expire at The End of The 2025 tax year.

Related TopicsSource of news: bbc.com