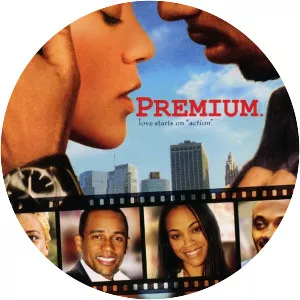

Premium

| Use attributes for filter ! | |

| Initial release | March 6, 2006 |

|---|---|

| Directors | Pete Chatmon |

| Initial DVD release | April 17, 2007 |

| Screenplay | Pete Chatmon |

| Producers | Pete Chatmon |

| Date of Reg. | |

| Date of Upd. | |

| ID | 2313481 |

About Premium

Reginald "Cool" Coolidge (Dorian Missick) is an actor hoping for his big break away from stereotypical black roles. When his ex-fiancée, Charli (Zoe Saldana), pulls in to the gas station where he works, Cool realizes that he still loves her after three years apart. But there is one problem: Charli's wedding to another man is only 36 hours away. Desperate to win her back, Cool uses his talents as an actor to convince Charli that she is choosing the wrong man. …

Michael Jackson jacket sells for £250,000 at auction

... It sold for £93,750 ($115,000) - also including the buyer s Premium - as part of the four-day Propstore entertainment sale...

Rail services disrupted by latest ScotRail 24-hour strike

... Another dispute involving ScotRail drivers who were members of the Aslef union was resolved in July when they accepted a 5% pay increase and other benefits including an excess revenue share Premium...

Kate Bush heading to number one after chart rule reset

... A new record earns one " sale" when it is streamed 100 times on a subscription service like Apple Music or Spotify Premium; or 600 times on an ad-funded service...

Why do Vietnamese people make hazardous journeys to the UK?

... How do they get to the UK? Smuggling agents market two type of services to transport migrants to the UK - Premium or economy - according to...

Ten years with my insurers £said, 2,000 hike'

...Diane saw their annual house insurance Premium-shoot Diane s reward for staying with the same home insurance provider for 10 years was the rise in your annual Premium of £1,500 to £3,500...

"Ten years with my insurers £said, 2,000 hike'

Diane saw their annual house insurance Premium -shoot

Diane s reward for staying with the same home insurance provider for 10 years was the rise in your annual Premium of £1,500 to £3,500.

The 76-year-old, from Kent, said: "a pensioner, I do not like change. "She ended up to call search in The Phone book for a quote.

it is an example of the six million people who pay an Average of £200 to a lot of on premiums.

The City has found a regulator That consumers are overpaying by £1. 2 billion in the year.

the competition in the home market, and insurance, not, and loyal customers to work, to be punished, the Financial Conduct Authority (FCA) says.

It rises in the face of bans for automatic price and raising the awareness of companies to move consumers to cheaper deals, but said, "The Ball is now in industry's court".

"not This market is good for all consumers," said Christopher Woolard, executive Director for strategy and competition at the FCA.

"While a large number of people shop around, many loyal customers are not always good business. We believe this relates to around six million consumers.

"We have a package of possible remedies to these markets, the competition are really capable of, and for the solution of the problems That we have compiled. We expect That the industry work With Us as we do it. "

Mr Woolard said the review did not reveal the insurance industry was the violation of The Rules on the basis of the wholesale trade. But he said it was clear That changes will be made necessary, and some in the industry would accept That .

He said, in many cases - as in the case of the Diane - it was a lot of renewing easier for the consumer, a policy, sometimes just by ticking a box, as it is the switch to a cheaper deal.

The FCA said That More Than one in 10 people Paid very high prices for their insurance. A third of them were to be Paid in any danger in any way, perhaps older people or people with low.

some insurers have targeted price increases which, to switch to the less likely.

Possible FCA remedies include:

The FCA intends to publish its final report on possible remedies in the beginning of 2020, after a further consultation with industry and consumer groups.

the payment of a poverty PremiumBy Kevin Peachey, Personal Finance reporter

You have never had a problem with your insurer or bank, so they have remained with You for years.

What the FCA and other reviews, have shown That this stall is an expensive option - for both home and motor cover, and more.

loyalty doesn't pay.

Those unable to or uncomfortable with the search for a better deal online, or haggle, pays more. It is also an allusion in this FCA report on poverty, a Premium - You get a bad deal, if your finances are less "elastic" or are You struggling with the handling of money.

Many of the same people among The Eight million Left Behind an independent report That would be appreciated, if the UK a cashless society.

Certainly, You will feel, like the financial sacrifices of the advances in technology have changed the way we live our lives.

'Bold ideas'Huw Evans, Director-General of The Association of British insurers, the industry trade Association, said his members recognised That the home and car insurance markets could work better for the consumer That does not shop around for renewal.

But he added: "This is a Problem unique to the insurance. It is important That any unintended consequences carefully examined to ensure That a fair and balanced approach " is reached, the for all customers. "

The consequences could be more expensive the premiums for those shopping around, but the FCA said That while it was sharp, they hold a contest, the variation in the prices to cover the same risk was too great.

Gillian Guy , chief Executive of Citizens Advice , said: "it is great to see how the FCA the recognition That the insurance market is not working".

But they warned us That the FCA's report set out proposals only. "The FCA now needs to follow through on these bold ideas to stop loyal insurance customers are punished," She Said .

Citizens Advice and said it should not be left to find the consumer The Best deals. Rather, the market should be Set Up to ensure That everyone is fairly treated. But his advice for people looking for the lowest prices is:

personal finance, financial conduct authority (fca), car insurance, citizens advice, money, insurance

Source of news: bbc.com