Defiant Rates

| Use attributes for filter ! | |

| Genres | Hip-Hop/Rap |

|---|---|

| Albums | Destroy and Rebuild |

| No Rest For The Sickest | |

| The Nebulizer | |

| Sarm | |

| Apple Isle Child | |

| Untold | |

| Record labels | Obese Records |

| Warner Music Australasia | |

| LMR Entertainment | |

| Lookup | |

| ABK Records | |

| Songs | 2013 |

| List | 2013 |

| 2016 | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1707759 |

About Defiant Rates

World Bank: Global rate hikes could trigger 2023 recession

... Central banks have raised Rates " with a degree of synchronicity not seen over the past five decades" to tackle soaring prices, it said...

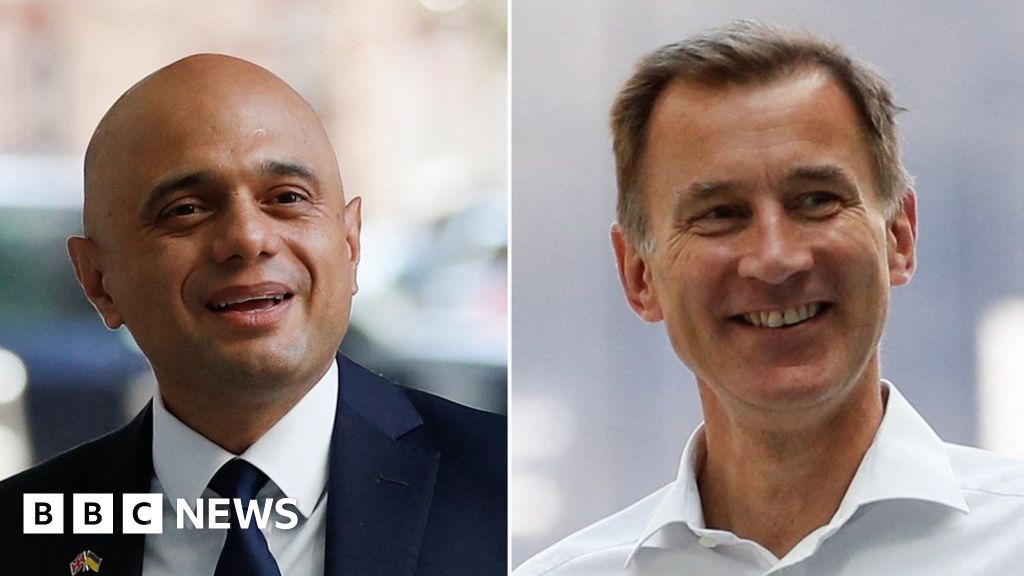

Tory leadership race: Rivals battle over tax cutting pledges

... He says that, if elected, he would also freeze business Rates - a tax on commercial property - for the poorest areas for five years...

Zero Covid holds danger for China's Xi

... After the initial outbreak in Wuhan, the country has been kept inside a giant Covid protection bubble, shielding the population from the high death Rates experienced elsewhere, but it has come at a cost - and growing political risk...

Top student loan interest rate cut by 5% in England

... Confirmation of student interest Rates is usually made in August, but Ms Donelan said the government had " brought forward this announcement to provide greater clarity and peace of mind for graduates at this time"...

Newport: Can an Instagram-able market save a city centre?

... " If you can offer cool independent clothing brands, a place that reflects sustainability, with some great food and the ability to work there in a cool and innovative office with affordable Rates...

Turkey's cost of living soars nearly 70%

... But Turkey s problems have been made worse by its president s reluctance to raise interest Rates - a commonly used tool to help cool inflation...

Local elections 2022: A simple guide to English council elections

......

The whistleblowing bankers who were sent to jail

...Two traders jailed for rigging interest Rates were the original whistleblowers of the scandal, the BBC has learned...

Top student loan interest rate cut by 5% in England

The maximum interest rate on student loans in England is being cut by almost 5%, the government says.

The maximum rate had been predicted to rise to 12% in the autumn, according to The Institute for Fiscal Studies (IFS).

Higher Education Minister Michelle Donelan said the cap was being reduced to 7. 3% to provide " peace of mind for graduates" as the cost of living grows.

The National Union of Students (NUS) said the interest cap was " still cruelly high".

The IFS welcomed The Announcement But said it would " have little of no effect" on most graduates' repayments.

The interest rate on the loan for those currently at university in England is calculated by adding 3% to the retail price index (RPI) measure of inflation.

The RPI figure confirmed in April set the interest rate for The Coming academic Year - and the IFS said the maximum rate on student loans would jump from 4. 5% this Year to 12% from September 2022.

Confirmation of student interest Rates is usually made in August, But Ms Donelan said the government had " brought forward this announcement to provide greater clarity and peace of mind for graduates at this time".

" The government has always been clear that where it can help with rising prices we will, and I will always strive for a fair deal for students, " she added.

However, Larissa Kennedy, NUS president in the UK, said: " These interest rate figures are still cruelly high.

" While some graduates might breathe a sigh of relief that the interest rate is no longer in double figures, ministers should be prioritising providing urgent cost-of-living support here and now, " She Said .

She added that the government " should introduce rent protections, offer basic levels of maintenance support and announce a cost-of-living payment for all students".

The Announcement from the government does not change the amount that borrowers repay each month.

For students starting degree courses from 2023,

Ben Waltmann, senior research economist at the IFS, said it was " great" that " the government has decided to take action to avoid the rollercoaster" of interest Rates - But " for most graduates this announcement will have little or no effect on their repayments".

That is because Most People with undergraduate loans will " likely never pay off their loans in full, so the interest rate never affects their repayments" He Said .

" Even for the typically high-earning graduates who do pay off their loans, very high interest Rates from September to February would have been counterbalanced by very low interest Rates further down The Line , which now won't come to pass either, " he added.

Source of news: bbc.com