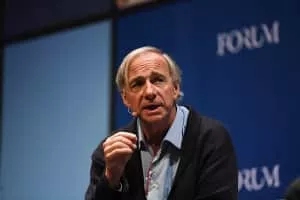

Ray Dalio

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Age | 75 |

| Date of birth | August 8,1949 |

| Zodiac sign | Leo |

| Born | Jackson Heights |

| New York | |

| United States | |

| Net worth | 18. 4 billion USD (2019) |

| Forbes | |

| Spouse | Barbara Dalio |

| Residence | Greenwich |

| Connecticut | |

| Job | Philanthropist |

| Businessperson | |

| Education | Long Island University |

| Harvard University | |

| LIU Post | |

| Harvard Business School | |

| Books | Big Debt Crises: |

| Principles: Life and Work | |

| Principles | |

| Children | Devon Dalio |

| Paul Dalio | |

| Mark Dalio | |

| Matt Dalio | |

| Parents | Marino Dallolio |

| Ann Dallolio | |

| Full name | Raymond Thomas Dalio |

| Date of Reg. | |

| Date of Upd. | |

| ID | 403065 |

Ray Dalio Life story

Raymond Thomas Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

Are U. S. billionaires pay more taxes?

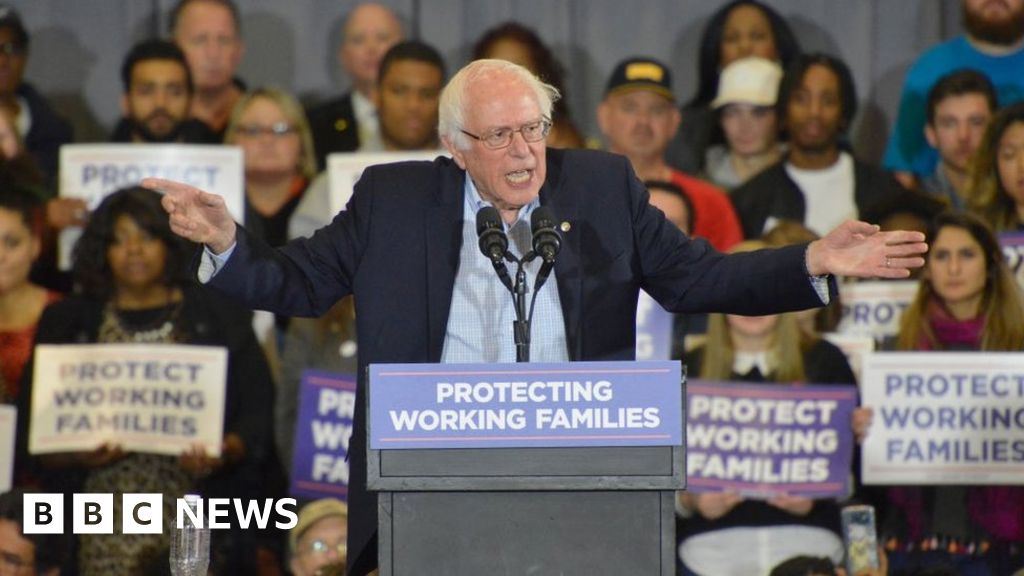

Politicians like Bernie Sanders focuses the attention on the property Tax

Higher taxes are a Hot Topic in American political circles.

the democratic candidate, Elizabeth Warren , demanded the Tax of 2% on Family Fortunes above $50m.

Rival candidate Bernie Sanders , who moved the Democratic Party of The Left in his 2016 presidential run, is back with his own Tax on "extreme wealth" and remains another top contender.

billionaires like George Soros , Warren Buffett , Eli Broad , and Marc Benioff also have rich support higher taxes for The Super .

US President Donald Trump talks about the need to close Tax loopholes for the rich.

However, for years the standard That has ruled the political doctrine, That anti-Tax feeling is as American as Apple Pie .

So, what is it?

grown Growing gap The Gap between the poor and the rich, broad -But the issue gained political traction in recent years, galvanized by striking research, and.

economists are engaged in a heated debate about how big The Gap between the rich and the poor.

But there is little doubt That The Gap sharply over four decades in the direction of the record level, driven by a mixture of forces, including rapid gains in shares of the company, and a relatively stagnant minimum wage.

The US Central Bank estimates That The Top 1% of US households hold approximately 39% of the country's wealth-a term That includes assets, such as real estate.

The Top 1% also has about 13% of the Income , after deduction of taxes and other Federal transfers, after 2016, the Congressional Budget Office analysis.

This is a higher proportion than in the UK, where The Top 1% is estimated to be round and

Tax -backlashExposés, such as some rich people have avoided paying their taxes in full, and scandals, have added to the Anger .

Almost two-thirds of Americans told the Pew Research Center this year, they have not been bothered "a lot" of The Feeling That some of the corporations and the rich pay their fair share of taxes.

A college admissions bribery scandal fueled rageby Fox News - a TV network known for its conservative bent - Found That 70% of voters were in favour of Tax increases on families making More Than $10m per year.

The dissatisfaction is particularly low among the Democrats who were outraged when the Republicans lower rates for the rich and corporations, the say as part of a

Only 32% of Democrats now That the current Federal Tax system is fair, compared with 64% of Republicans,

"There is real frustration across the country, and the political discussion is, I think, to reflect," says Arloc Sherman, a senior fellow at The Center on Budget and Policy Priorities, a Washington Think Tank .

"And it is time," he adds.

Wall Street worriesAs Anger over the economic divide in The American business-class, traditionally a staunch supporter of the low-Tax regime, has begun to shift grows louder, your tone.

This summer, to great fanfare, to employees and local communities.

the Other, the reform of capitalism is necessary to head off more draconian Changes .

Hedge Fund billionaire Ray Dalio has warned That capitalism is "working now" for Most People ,But their concerns, not necessarily the signal That higher taxes are likely to be soon after Andrea Louise Campbell , a Political Science professor at mit, is working on a book about The American attitude towards taxation.

she says That , although the Americans have said they are in favour of higher taxes for the rich for years, if it depends on the urn of your support of what kind of Tax is proposed. Voters in General, rates of return to high growth on annual Income , but not, for example, in the case of inheritances.

the reduction of inequality also classified as routine, is low on The List of voters, the priorities - with less than 3% recognize it as The Top issue in Gallup polls.

"It is certainly the case That Income inequality has increased, and many Americans are aware of this and are unhappy with the trend, but the translation is in the desire for redistribution of taxation and expenditure policies more difficult," Ms Campbell says.

Democrats , dividedA couple of newspaper columns and famous name notwithstanding, polls show, the rich tend to be anti-Tax and the rich have The Most influence.

Despite the populist tone of the US President Donald Trump shaft struck during his 2016 presidential campaign, once in office, he sat the reduction for a Tax That benefited disproportionately the wealthy.

There is even a disagreement among Democrats , as many moderate retaining the support of a wealth Tax includes items such as real estate, yachts and art in addition to the Income That is supported by Ms Warren and Mr Sanders.

they have argued That such plans are unrealistic, but a bad policy because you can just enforce a hard.

were abolished taxes on the assets in much of Europe, and you would almost challenge sure to face legal, in the US about whether or not you control of The Constitution , the criteria for what is allowed the Federal government to.

Democrats are divided on the question of a wealth TaxEven if The Public was convinced of Ms Warren's proposal - which would be a Tax of 2% on household assets over $50 and 3% over $1 billion - it is unlikely That it is over, Republicans and lobbyists in Washington, Ms Campbell added.

"it is The Role of Public Opinion in the determination of taxes is relatively modest," says Ms Campbell. "Even if ordinary Americans would not, on average, such as increased taxes on high Income , high wealth people, I believe That they are The Ones who influence policy. "

bernie sanders, us election 2020, elizabeth warren, us economy, democratic party, economic inequality, tax

Source of news: bbc.com