Reasonable Care

| Use attributes for filter ! | |

| Originally published | 1989 |

|---|---|

| Authors | Grant Gillett |

| Date of Reg. | |

| Date of Upd. | |

| ID | 2462653 |

About Reasonable Care

Coldplay and ex-manager locked in multi-million pound court battle

... " Had Mr Holmes exercised Reasonable Care and skill in the performance of his obligations" the counter-claim continues, the band would not have incurred costs of at least £17...

New Zealand: Plate-sized surgical tool left in woman's abdomen for 18 months

... Initially, Auckland s health district board Te Whatu Ora Auckland had argued they had not failed to exercise Reasonable Care and skill...

Croydon tram crash: Driver not guilty over fatal derailment

...The driver of a tram that crashed in Croydon in November 2016, killing seven people, has been cleared of failing to take Reasonable Care at work...

Croydon tram crash: Passengers flung before fatal impact, trial told

... Mr Dorris, from Beckenham, south-east London, is accused of failing to take Reasonable Care at work...

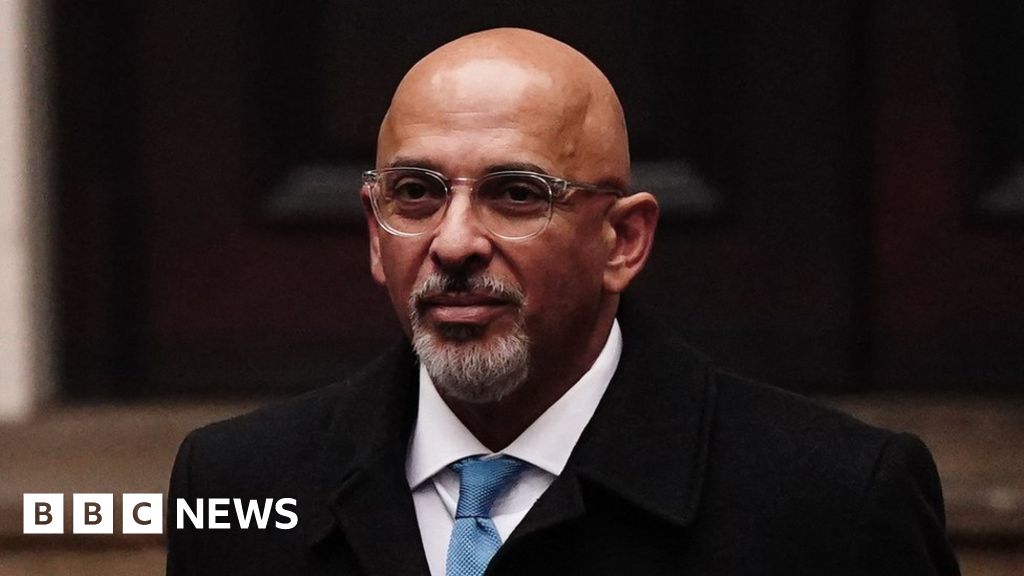

No penalties for 'innocent' tax errors, HMRC boss says

... Mr Harra stressed he could not comment on individual cases but said penalties were not applied when someone had taken " Reasonable Care"...

Croydon tram crash: TfL to admit to failings over fatal derailment

... He indicated a not guilty plea to an allegation of failing as an employee to take Reasonable Care of passengers...

Judges overturn boy's £290,000 diving death payout

... Lord Carloway wrote: " It was sufficient in the exercise of Reasonable Care for the defenders to have provided a safe means of moving from the seat to the exit point in the form of a non-slip and unobstructed deck, handrails and a deckhand...

'You feel shame' - the reality of romance scams

... Now any victim who has taken Reasonable Care, or has any element of vulnerability, is much more likely to receive a refund of the lost money...

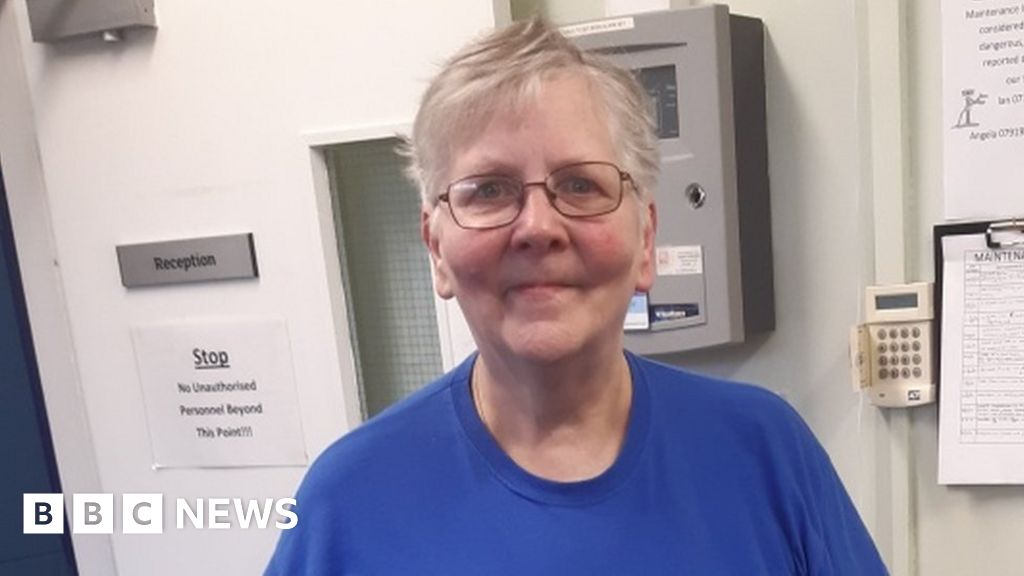

'You feel shame' - the reality of romance scams

Elspet now works as a scam marshal, offering help to others

Brian had promised Elspet a bright Future - a wonderful marriage later in life and their own bungalow.

But Brian was not real. He was a romance scammer, something Elspet did not realise until she had sent Him £10,000.

They had met on a dating website, she had been taken in over email, and The Money - including life savings - is now in his hands and lost to her.

Elspet had been convinced by his story of serving abroad in the military. She trusted Him enough To Believe that his friend, a diplomat, was bringing home his belongings but needed money for fares and courier fees. It was a lie.

"You feel shame. You feel stupid and depressed," said Elspet, aged 67.

Now she works as a scam marshal, listening to victims and warning people in her community centre about the danger of this kind of fraud.

"I tell people they should report it, not Be Afraid to talk to family and friends. They do not need to be alone in this," She Said .

New figures show that her work is more needed than ever.

Romance scam cases rose by 64% in The First half of the year compared with the same period a year earlier, according to the data from banking trade body, Uk Finance .

Fraudsters choose their victims by looking for signs of vulnerability, trawling through profiles, and winning trust over weeks and months.

In Total , £7. 9m was lost to 935 people between January and June, with Only £500,000 of that returned to victims.

Previous research has suggested the majority of victims are women, and they lose twice as much on average as men.

Online Safety adviceRomance fraud represents Only a small fraction of losses to so-called authorised push payment (APP) fraud. This is when a criminal tricks their victim into sending money directly from their savings to an account which The Criminal controls.

In The First half of the year, APP fraud losses totalled £208m in 58,000 cases - the vast majority of victims being individuals, rather than businesses. The Number of cases was 69% higher, and losses 40% higher than the same period a year earlier. However, banks said there were better records of these scams being made by banks, and victims were more likely to come forward.

Only £39m (19%) of this was refunded by the banks. Until recently, banks considered payments to have been agreed to by victims, so would not automatically refund The Money as they would in other types of fraud, such as when debit card details were compromised.

New codeIn May, a group of the biggest banks agreed to a new voluntary code which included a new set of criteria to judge whether the customer should get The Money back. It is proposed that the compensation would come from a central pot gathered from a transaction fee on all Bank transfers over £30 and paid by those banks signed up to the scheme.

Now any victim who has taken Reasonable Care , or has any element of vulnerability, is much more likely to receive a refund of the lost money. A victim who has been "grossly negligent" will not be reimbursed.

Having Only launched in May, the effect of the scheme is yet to be seen in the fraud figures which cover The First half of the year.

One Bank - Tsb - has broken ranks in that it would automatically refund all "innocent" customers who have been defrauded.

However, other banks have suggested that a blanket refund policy would simply encourage fraudsters to try their Luck .

uk banking, personal finance, fraud, money

Source of news: bbc.com