Simon French

| Use attributes for filter ! | |

| Gender | Male |

|---|---|

| Google books | books.google.com |

| Born | Australia |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1746560 |

Simon French Life story

Simon French was born and raised in Australia. He wrote his first novel while still in high school. He has written several novels and picture books, published in Australia and overseas. ...

The flashing warning sign that is worrying investors

... It is likely to impact whichever party wins the UK general election tipped for next year, says Simon French, a managing director at investment bank Panmure Gordon...

UK wages grow at record rate

... Simon French, chief economist at Panmure Gordon, said that inflation could fall to 7% or even 6...

Could a US debt default unleash global chaos?

... However, if it did, " it would make the global financial crisis look like a tea party" says Simon French, chief economist at investment bank Panmure Gordon, referring to the near collapse of the world s banking industry in 2008...

Investors remain calm despite political chaos

... Simon French, chief economist at Panmure Gordon, told the BBC: " The UK Government can borrow for 10 years at about 4% - that number has come down in recent days, but it s [the UK Government] paying about 0...

Faulty drainage work blamed for fatal Stonehaven derailment

... What has the reaction been? Simon French, the chief inspector of rail accidents, said the industry owed it to everyone affected by the tragedy to learn safety lessons for the future...

Metal price rise will make canned food more expensive, says LME chief

... " Panmure Gordon economist Simon French told the BBC that the UK s inflation rate could now hit 10% because of higher costs, and on Thursday an industry body warned that UK household energy bills could reach as high as £3,000 a year...

Lorry stuck on Essex crossing barrier almost hit by train

... Simon French, chief inspector of rail accidents, said it was almost a disaster , adding that Network Rail and Amey Inabensa had addressed the factors to stop it happening again...

The flashing warning sign that is worrying investors

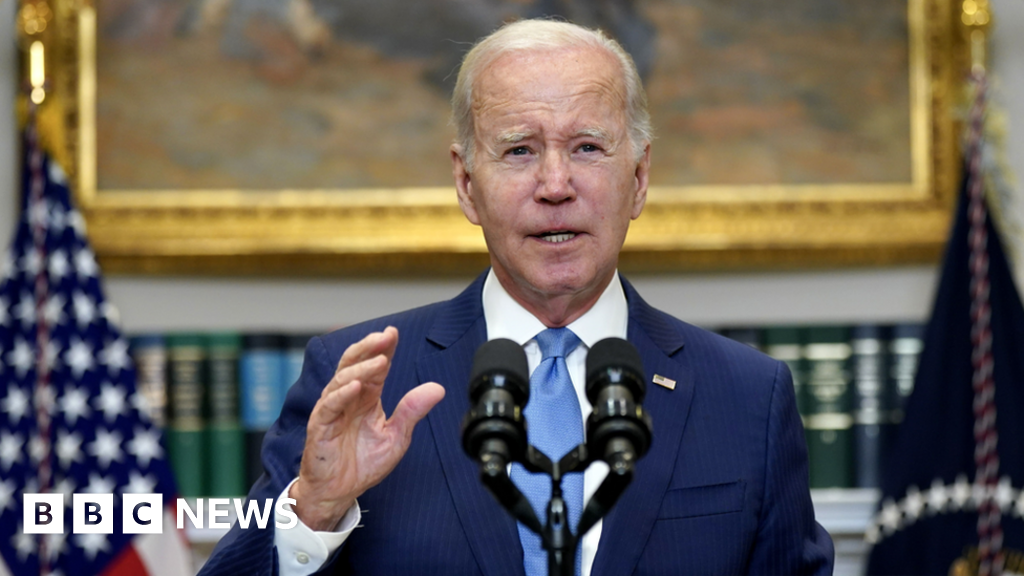

By Daniel ThomasBusiness reporter

It's not something Your Friends are likely to be talking about down The pub but in The City there's something fund managers and investors are increasingly worried about.

Bond markets.

They are falling and have been for some time.

It is a flashing warning sign about The State of The UK and US economies and may affect The costs of our loans and mortgages.

So how worried should we be?

What is a bond?Governments borrow money by selling financial products called Bonds . A bond is A Promise to pay money in The Future . Most require The Borrower to make regular interest payments over The Bond 's lifetime.

UK government Bonds - known as gilts - are normally considered very safe investments, with little risk The Money will not be repaid. US government Bonds - known as Treasuries - are also considered very safe.

What's going on in The Bond market?Over The Last Year or so, there has been a sell-off of government Bonds on global markets that is having wider ramifications.

It Comes as central banks warn that Inflation - The rate at which prices Rise - is likely to stay higher for longer than previously expected.

Since 2021, central banks have repeatedly put up interest rates to try to tame Inflation , lifting them from close to zero to where they are now: 5. 25% in The UK and 5. 25%-5. 50% in The US.

And when official rates Rise , The yields on government Bonds also tend to go up to attract buyers, driving up borrowing costs for governments and consumers in The Process .

Benchmark 10-year US Treasury yields surged to 4. 91% in mid-October - their highest level since The financial crisis of 2007. In The UK, 30-year gilt yields hit a 25-year high of 5. 115% earlier in The month, with similar moves seen elsewhere in Europe.

As yields Rise , investors tend to dump The older Bonds they already hold in favour of newly issued ones that pay higher rates.

As a result, bond prices tend to fall, which affects anyone who owns these assets - hence The flashing lights We Are seeing in The markets.

How could this affect me?Government bond yields are used as a guide for setting The rates on everyday loans and mortgages, which have shot up over The Last few years.

Average US mortgage rates, squeezing borrowers. In The UK, The rate on an average five-year fixed residential deal was 5. 87% as on 31 October, down slightly from levels seen earlier this year but still high compared with a few years ago.

Rising bond yields are also putting pressure on governments.

That's because The Higher yields go, The more governments have to pay back in debt interest, which may leave them with less to spend on other things.

It is likely to impact whichever party wins The UK general election tipped for next year, says Simon French , a Managing Director at investment bank Panmure Gordon.

" The Higher bond rates go, The more interest that has to be repaid, The less there is for public services such as health and education, " he says.

Could higher borrowing costs push countries over The Edge ?That is highly unlikely, says Russ Mould , investment director at Aj Bell . " The UK hasn't defaulted on its debts since 1672 and The US has never defaulted. "

However, he says investors are feeling slightly more nervous about The " manageability" of these countries' debts after years of heavy government spending on things like The 2007-08 financial crisis, The Covid pandemic and The Ukraine war.

America's total debt stands at $33. 6 trillion (£27. 6tn) - up from $9tn in 2007. In The UK it's risen to £2. 5tn from £700bn over that time.

The more debt interest countries have to pay, The harder, theoretically, it may be for them to repay what they owe investors.

What is The Risk to investors?The Immediate risk is from The sharp Fall In bond prices, which is Bad News for investors and companies that hold these normally stable assets as collateral on their balance sheets.

Earlier this year, after The value of Bonds it held on its balance sheet collapsed. And when The government's mini-budget sparked turmoil on UK bond markets in 2022, forcing The Bank of England to step in.

Mr French expects we'll see more " unanticipated fallout" as The Bond sell-off continues but it won't become a systemic risk to The global economy.

" We Are certainly not in The Territory of 2008-09 or at The start of The pandemic when there was proper fear Out There . But there is worry. "

What about The wider economy?The Bank of England and The US Federal Reserve both think a recession can be avoided in their respective countries.

But Mr Mould doesn't rule it out, adding that markets fear " we will end up with painful Government Debt or painful Inflation " over The Next few years.

The Hope , he says, is that The UK and US central banks will steer their respective economies towards a " soft landing" by bringing down Inflation without hurting The economy.

" They got us through Covid and The energy price shock, and markets are hoping they can do it again. "

The big unknown is whether rising geopolitical tensions will spill over and make a bad situation worse.

Russia's invasion of Ukraine hit economies around The World as global energy prices spiked and governments were forced to intervene to help households.

Escalating tensions in The Middle East or between China and Taiwan could cause even more economic disruption, and some doubt that Western governments are prepared.

Related TopicsSource of news: bbc.com