Southern Water

| Use attributes for filter ! | |

| Ceo | Ian McAulay |

|---|---|

| Headquarters | Worthing |

| United Kingdom | |

| Number of employees | 2,092 |

| Production output | 0. 529 Gl/day (drinking); 0. 730 Gl/day (recycled) |

| Parent organizations | SWS Holdings Ltd. |

| Areas served | Hampshire |

| Isle of Wight | |

| Sussex | |

| Kent | |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1061668 |

About Southern Water

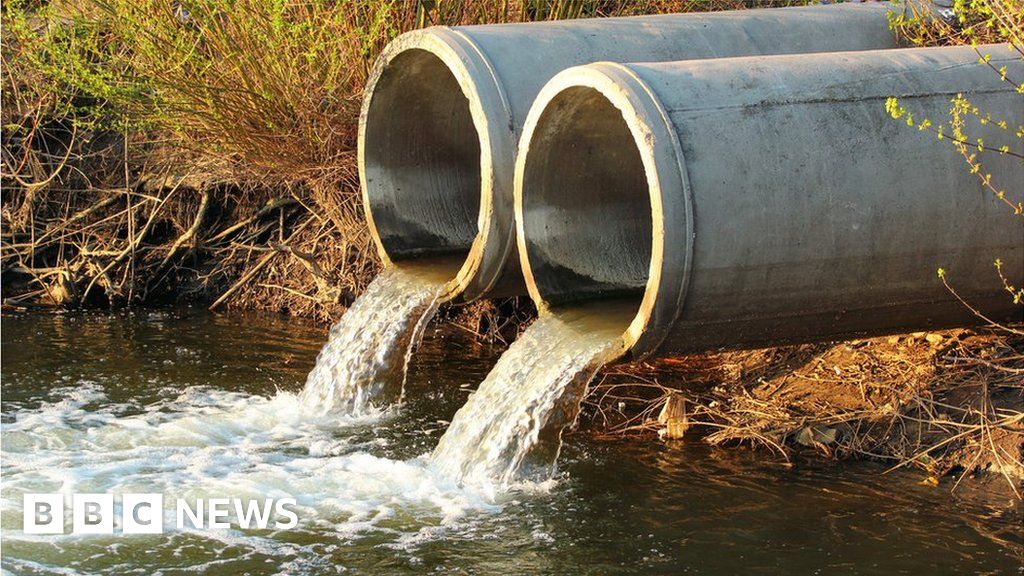

Southern Water is the private utility company responsible for the public wastewater collection and treatment in Hampshire, the Isle of Wight, West Sussex, East Sussex and Kent, and for the public water supply and distribution in approximately half of this area.

Why is sewage pumped into rivers and the sea?

... A recent BBC investigation suggests 388 potential " dry spills" by Thames, Wessex and Southern Water in 2022...

Water firms illegally spilled sewage on dry days - data suggests

... Thames, Wessex and Southern Water appear to have collectively released sewage in dry spills for 3,500 hours in 2022 - in breach of their permits...

Ofwat complacent over Thames Water affair - MP

... The management of Southern Water is also up for scrutiny...

Southern Water bosses decline bonuses after sewage discharge anger

...By Christian FullerBBC NewsSouthern Water bosses have opted not to take bonuses following criticism of the company s sewage discharge record...

Thames Water fined £3. 3m over river sewage

... The record fine against a water company for illegal discharge of sewage is held by Southern Water at £90m...

Why is Thames Water in so much trouble?

... Meanwhile, last December Ofwat raised concerns about the financial resilience of five companies: Thames Water, Southern Water, Yorkshire Water, SES and Portsmouth...

Water companies say sorry over spilling raw sewage

... The water companies - Anglian Water, Northumbrian Water, Severn Trent Water, South West Water, Southern Water, Thames Water, United Utilities Water, Wessex Water and Yorkshire Water - said they were ready to invest £10bn to upgrade their sewage infrastructure and also establish 100 new swimming areas...

Isle of Wight man, 82, won't leave collapsing cliff house

... 52m) and Southern Water has offered him alternative accommodation...

Why is Thames Water in so much trouble?

By Dearbail Jordan & Ben KingBBC News

Thames Water may have to be taken over by the government if it runs out of money.

But why is the UK largest water company facing a Crisis - and are other firms facing similar problems?

How did Thames Water end up with so much debt?When The Company was privatised in 1989, it had no debt. But over The Years it borrowed heavily and currently has £14bn in borrowings.

A large proportion of that debt was added when Macquarie, an Australian infrastructure bank, owned Thames Water , reaching over £10bn when The Company was sold in 2017.

Macquarie has argued that it invested billions in upgrading Thames's water and sewage infrastructure while it owned The Company .

But critics argue that more out of The Company in loans and dividends.

Analysts say Thames Water 's debt amounts to 80% of the value of The Business , Making It The Most heavily indebted of England and Wales' water companies.

And interest payments on More Than half of The Debt rise with inflation, which has been stubbornly high this past year, helping to push The Company to The Brink .

Are all water companies in trouble?Thames Water 's travails have certainly put a spotlight on what is a debt-laden industry. According to the regulator Ofwat, the sector's total debt reached £60. 6bn by March Last Year .

Of the 11 companies that provide water and sewage services in England and Wales, six are owned by or controlled by overseas investors from countries including Hong Kong , Canada and Malaysia. Like Thames Water , critics claim that overseas owners have loaded water companies up with debt and paid themselves handsome dividends at the expense of investment.

While the sector has - Like other industries - been hit by higher costs for things Like chemicals and energy, The Key problem for water companies is that the interest that they pay on their debt is linked to the retail price index (RPI) measure of inflation. This is usually higher than the consumer price index (CPI) measure of inflation. For example, in May RPI inflation was 11. 3% compared to CPI inflation of 8. 7%.

Ofwat estimates that half of water companies' debt is linked to inflation and the vast majority of that is tied to the RPI measure.

Meanwhile, last December Ofwat raised concerns about the financial resilience of five companies: Thames Water , Southern Water , Yorkshire Water , SES and Portsmouth. Yorkshire, Southern, Portsmouth and SES say they have taken steps to address Ofwat's concerns.

Who owns Thames Water ?Thames Water is owned by a group of investors spanning four continents. The largest is The Canadian pension fund, OMERS, with 31. 8%.

The second-largest is the Universities Superannuation Scheme, with 19. 7%, a pension fund for UK academics.

Other investors include sovereign wealth funds from China and Abu Dhabi which invest those nation's assets on behalf of their governments.

Three other pension funds and two investment firms Make Up the rest.

Why was Thames Water privatised?The entire water and waste sector was privatised 34 years ago under Margaret Thatcher 's Conservative government for £7. 6bn. At The Time , Mrs Thatcher wrote off the industry's £5bn debt, leaving companies with a Clean Slate and gave them £1. 5bn in public money.

The government had wanted to privatise the industry in 1984 but a public backlash against The Plan saw it shelved until after The General election three years later. At The Time , the UK was Under Pressure from Europe to improve the purity of its water.

However, meeting European standards would costs billions of pounds worth of investment.

Related TopicsSource of news: bbc.com