The Economist

| Use attributes for filter ! | |

| Headquarters | Westminster |

|---|---|

| London | |

| United Kingdom | |

| Editors | Zanny Minton Beddoes |

| Circulation | 1,114,549 (print) |

| First issue date | September 1843 |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1256988 |

About The Economist

The Economist is an English-language weekly magazine-format newspaper owned by the Economist Group and edited at offices in London. Continuous publication began under its founder James Wilson in September 1843.

Ukraine war: Soldier tells BBC of front-line 'hell'

... Ukraine s commander-in-chief Gen Valery Zaluzhny told The Economist magazine in November that, " just like the First World War we have reached the level of technology that puts us into a stalemate...

Why businesses are pulling billions in profits from China

... " Anxieties around geopolitical risk, domestic policy uncertainty and slower growth are pushing companies to think about alternative markets, " says Nick Marro from The Economist Intelligence Unit (EIU)...

Ukraine war: Grenade birthday gift kills army chief Zaluzhny's aide

... " Just like in World War One, we have reached the level of technology that puts us into a stalemate, " he told The Economist...

Li Keqiang: Chinese grieve popular ex-premier in quiet show of dissent

... Li was best-known outside of China for the Li Keqiang index, a term coined by The Economist to measure China s true economic growth, after Li described his country s gross domestic product figures as " man-made" in a private meeting with US officials...

Evergrande: Why should I care if China property giant collapses?

... The Economist Intelligence Unit s Mattie Bekink thinks so: " Rather than risk disrupting supply chains and enraging homeowners, we think the government will probably find a way to ensure Evergrande s core business survives...

Shrinkflation strikes again as Galaxy chocolate gets smaller

... Pippa Malmgren, The Economist credited with coining the phrase " shrinkflation" more than a decade ago, said brands are hoping shoppers won t register these change...

Which criminal case may be hardest for Trump to win?

... Sarah Isgur, legal commentator at conservative website The Despatch, told The Economist the statutes under which these counts were brought require proof of intent...

Higher food prices may be here to stay, says Bank economist

... 2% in March, During a question-and-answer session with MPs on Monday, The Economist admitted it was still not a " very comfortable level"...

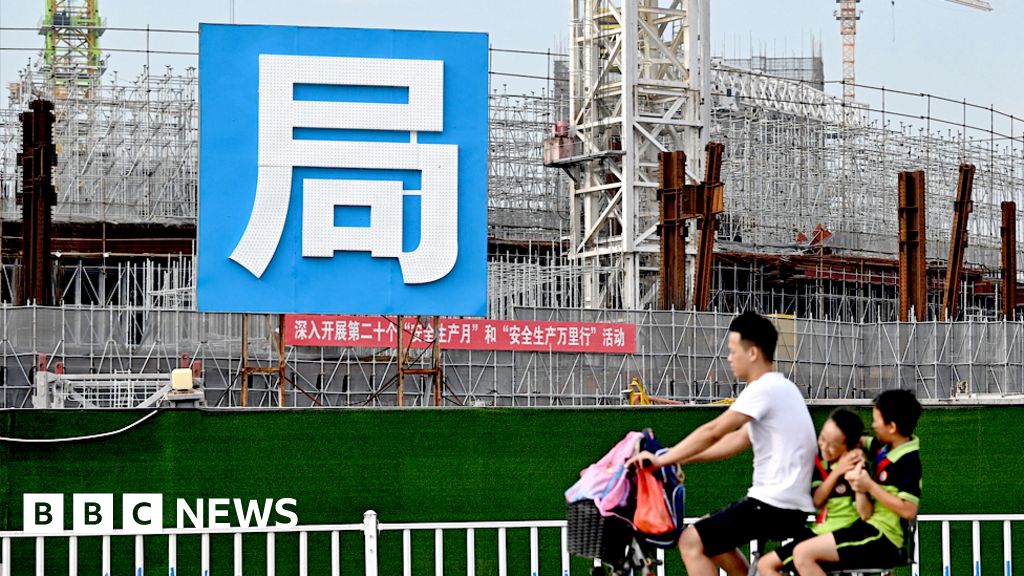

Evergrande: Why should I care if China property giant collapses?

A crisis at The World 's most indebted company has worsened after reports that its chairman has been placed under police surveillance.

It Follows earlier reports that other current and former executives at Chinese property giant Evergrande had also been detained.

Evergrande suspended the trading of its shares in Hong Kong on Thursday.

It marks another low for The Firm which after missing a crucial repayment deadline, triggering China's current Real Estate market crisis.

What does Evergrande do?Businessman Hui Ka Yan founded Evergrande, formerly known as the Hengda Group, in 1996 in Guangzhou, southern China.

Evergrande Real Estate currently owns More Than 1,300 projects in More Than 280 cities Across China .

The broader Evergrande Group now encompasses far More Than just Real Estate development.

Its businesses range from wealth management to making electric cars and food and drink manufacturing. It even owns one of the country's biggest football teams, Guangzhou FC.

Mr Hui was once Asia's richest person worth an estimated $36. 2bn in 2019, according to Forbes. But his wealth has plummeted since then, with his personal fortune now (£2. 6bn).

Why is Evergrande in trouble?Evergrande expanded aggressively to become one of China's biggest companies by borrowing More Than $300bn.

In 2020, Beijing brought in new rules to control the amount owed by big Real Estate developers.

The new measures led Evergrande to offer its properties at major discounts to ensure money was Coming In to keep The Business afloat.

Now it is struggling to meet the interest payments on its debts.

This uncertainty has seen Evergrande's shares lose More Than 99% of their value in The Past three years.

In August, in a bid to protect its US assets as it worked on a multi-billion dollar deal with creditors.

Why would it matter if Evergrande collapses?There are several reasons why Evergrande's problems are serious.

Firstly, many people bought property from Evergrande even before building work began. They have paid deposits and could potentially lose that money if it goes bust.

There are also the companies that do business with Evergrande. Firms including construction and design firms and materials suppliers are At Risk of incurring major losses, which could force them into bankruptcy.

The third is the potential impact On China 's financial system: If Evergrande defaults, banks and other lenders may be forced to lend less.

This could lead to what is known as a credit crunch, when companies struggle to borrow money at affordable rates.

A credit crunch would be very Bad News for The World 's second largest economy, because companies that can't borrow find it difficult to grow, and in some cases are unable to continue operating.

This may also unnerve foreign investors, who could see China as a less attractive place to put their money.

Is Evergrande 'Too Big to fail'?The very serious potential fallout of such a heavily indebted company collapsing has led some analysts to suggest that Beijing may step in.

The Economist Intelligence Unit's Mattie Bekink thinks so: " Rather than risk disrupting supply chains and enraging homeowners, we think the government will probably find a way to ensure Evergrande's core business survives. "

Others though are not sure.

In a post On China 's chat app and Social Media platform WeChat, the influential editor-in-chief of state-backed Global Times newspaper Hu Xijin said Evergrande should not rely on a government bailout and instead needs to save itself.

This also chimes with Beijing's aim to rein in corporate debt, which means that such a High Profile bailout could be seen as setting a bad example.

You may also be interested in:Source of news: bbc.com