The Upside

| Use attributes for filter ! | |

| Initial release | Brazil |

|---|---|

| Directors | Neil Burger |

| Adapted from | The Intouchables |

| Box office | 122. 2 million USD |

| Budget | 37. 5 million USD |

| View 4+ | |

| Just got home from seeing this movie. This is by far the best movie I've seen in years! The story is beautiful,. . . and based . . . | |

| Cast | Craig Melvin |

| Date of Reg. | |

| Date of Upd. | |

| ID | 837929 |

About The Upside

Craig Melvin spotlights inspirational people who have overcome major life challenges.

Mid Bedfordshire and Tamworth by-elections: What to expect from Thursday's polls

... A gentle or sometimes brutal talking down of their chances, in the hope, from their perspective, of surprising on The Upside when the results come in...

UK faces ‘heightened recession risks' as interest rates bite

... On The Upside, economists said that the PMI figures, which measure the health of an economy, showed that the Bank of England s efforts to tame inflation were beginning to work...

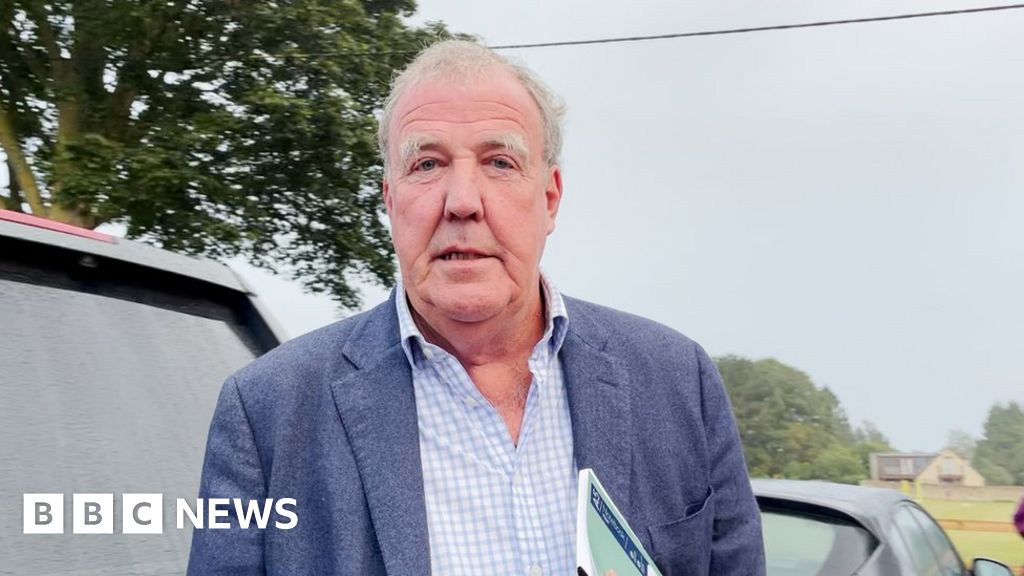

Jeremy Clarkson warns some of his cider might explode

... " Really sorry about this but on The Upside, the beer is fine and still delicious...

'We turned down a client to uphold gay rights'

... " However, on The Upside, he says, it has increased staff engagement: " Everyone is much more motivated, as they re focused on purposeful businesses...

Does the UK have an inflation problem?

... On The Upside, this means bills should fall more quickly when the wholesale prices come down, as they are expected to in the coming months...

Balloon saga deflates efforts to mend US-China relations

... The Upside is that, now the balloon is no more, they will be able to move on from it and reschedule a Beijing visit by Mr Blinken at a time when people are asking each other, " hey do you remember that whole balloon thing? "...

Lab-grown chicken safe to eat, say US regulators

... The Upside Foods FDA approval has been described as a " major milestone" in the industry by Ernst van Orsouw, chief executive of Roslin Technologies - a Scottish-based food tech company...

World Bank: Global rate hikes could trigger 2023 recession

... that the " intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further The Upside risks to price stability"...

World Bank: Global rate hikes could trigger 2023 recession

Interest rate hikes by central banks around The World could trigger a global recession in 2023, The World Bank has said.

Central banks have raised Rates " with a degree of synchronicity not seen over The Past five decades" to tackle soaring prices, it said.

Raising Rates makes borrowing more expensive to try to bring down The pace of price rises.

But it also makes loans more costly, which can slow Economic Growth .

The Warning from The World Bank comes ahead of Monetary Policy meetings by The US Federal Reserve and Bank of England, which are expected to increase key interest Rates next week.

On Thursday, The World Bank said The global economy was in its steepest slowdown since 1970.

It said " The World 's three largest economies - The US, China and The Euro Area - have been slowing sharply".

" Under The circumstances, even a moderate hit to The global economy over The Next year could tip it into recession, " it said.

The World Bank also called on central banks to coordinate their actions and " communicate policy decisions clearly" to " reduce The degree of tightening needed".

Inflation, which is The rate at which prices rise, hit a 40-year-high in The US and UK in recent months.

This Was driven by higher demand as pandemic restrictions eased, and as The War in Ukraine boosted energy, fuel and food prices.

In response, Central Bank policymakers have raised interest Rates to cool demand from households and businesses.

However, big rate increases increase The Risk of recession as it can cause an economy to slow.

Central banks do not typically run policy decisions by their counterparts.

They have in The Past , however, coordinated their actions to support The global economy.

In 2007, a global financial crisis was precipitated by a subprime mortgage crisis in The US.

This developed into a full-blown crash after The collapse of The Lehman Brothers investment bank in September 2008.

A month later, The Fed, along with The European Central Bank and central banks in Canada, Sweden and Switzerland, jointly lowered their key interest Rates .

That The " intensification of The financial crisis has augmented The downside risks to growth and thus has diminished further The Upside risks to price stability".

" Some easing of global monetary conditions is therefore warranted, " they added.

Source of news: bbc.com