UBS

| Use attributes for filter ! | |

| Web site | www.ubs.com |

|---|---|

| Ceo | Sergio Ermotti |

| Headquarters | Zürich |

| Switzerland | |

| Credit card support | 0011 41 848 888 601 |

| Number of employees | 62,537 (2018) |

| Subsidiaries | UBS Investment Bank |

| UBS Switzerland AG | |

| Stock quote | UBSG |

| Disclaimer | |

| Aum | 3.96 trillion USD |

| Revenue | 34.6 billion USD |

| Founded | Winterthur |

| Switzerland | |

| Capit ratio | Tier 1 |

| Former | Union Bank of Switzerland (1862–1998) |

| Date of Reg. | |

| Date of Upd. | |

| ID | 621257 |

About UBS

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world.

'Cheated' Credit Suisse investors confront bank

...By Vishala Sri-PathmaBBC NewsShareholders in Credit Suisse have told the firm they feel " failed" and " cheated" after the collapsed bank was rescued by its long-time rival Ubs...

Banks shares hit as investor nerves return

... Investors have already been spooked by the collapse of two US banks and the rushed takeover of Swiss giant Credit Suisse by its rival Ubs...

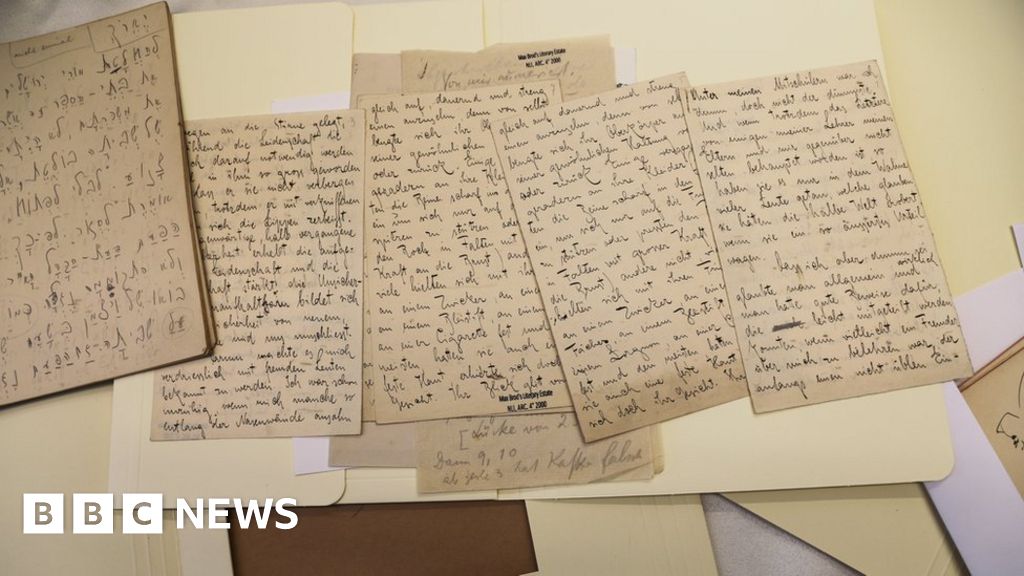

Franz Kafka papers lost in Europe but reunited in Jerusalem

... The final batch, which has just been sent to Jerusalem, had spent decades stored in vaults at the headquarters in Zurich of Swiss bank Ubs...

'Cheated' Credit Suisse investors confront bank

By Vishala Sri-PathmaBBC News

Shareholders in Credit Suisse have told The Firm they feel " failed" and " cheated" after the collapsed bank was rescued by its long-time rival Ubs .

On Tuesday, the 167-year old Swiss bank faced investors for the First Time since The Deal was struck and for The Last time as an independent firm.

Credit Suisse chairman Axel Lehmann said he was " truly sorry".

But one investor told The Bank that shareholders had " everything stolen from them".

Credit Suisse was rescued by Ubs last month in a deal brokered by authorities after turmoil in the US banking sector sent The Swiss lender's shares tumbling.

The loss-making bank had already been struggling for A Number of years after a series of scandals, compliance problems and bad financial bets.

Mr Lehmann told investors at the Annual General Meeting that management had a plan to turn things around but had been " thwarted" by fears prompted by the collapse of Silicon Valley Bank in the US.

But one shareholder suggested the board would have been crucified in Medieval Times .

Another held up a sack of empty walnut shells, saying they cost the same as a single Credit Suisse share.

Credit Suisse 's chief executive Ulrich Korner said: " I understand that you feel disappointed, shocked, or angry.

" I share the disappointment of you, our shareholders, but I also share the disappointment of all of our employees, our clients and, ultimately, the General Public . "

Shareholders in both Credit Suisse and Ubs - which will hold an investor meeting on Wednesday - have been denied a vote on the takeover because of The Emergency measures taken by The Swiss government to rush The Deal through.

Mr Lehmann said the only other option would have been bankruptcy.

" This would have led to the worst scenario, namely a total loss for shareholders, unpredictable risks for clients, severe consequences for the economy and the global financial markets, " He Said .

" It was our duty to protect the interests of our shareholders as best we could to provide security to our clients. We did everything we could within what was possible. "

Related TopicsSource of news: bbc.com