Wood Mackenzie

| Use attributes for filter ! | |

| Headquarters | Edinburgh |

|---|---|

| United Kingdom | |

| Ceo | Neal Anderson |

| Parent organizations | Verisk Analytics |

| VP | Khai Yang Koh |

| Founded | 1973 |

| Subsidiaries | Infield Systems Limited |

| Date of Reg. | |

| Date of Upd. | |

| ID | 1018545 |

About Wood Mackenzie

Wood Mackenzie, also known as WoodMac is a global energy, chemicals, renewables, metals and mining research and consultancy group with an international reputation for supplying comprehensive data, written analysis and consultancy advice.

Crunch talks due on deep-sea mining controversy

... Nick Pickens, research director of global mining at Wood Mackenzie, told the BBC many of these minerals are relatively abundant on land but can be difficult to reach...

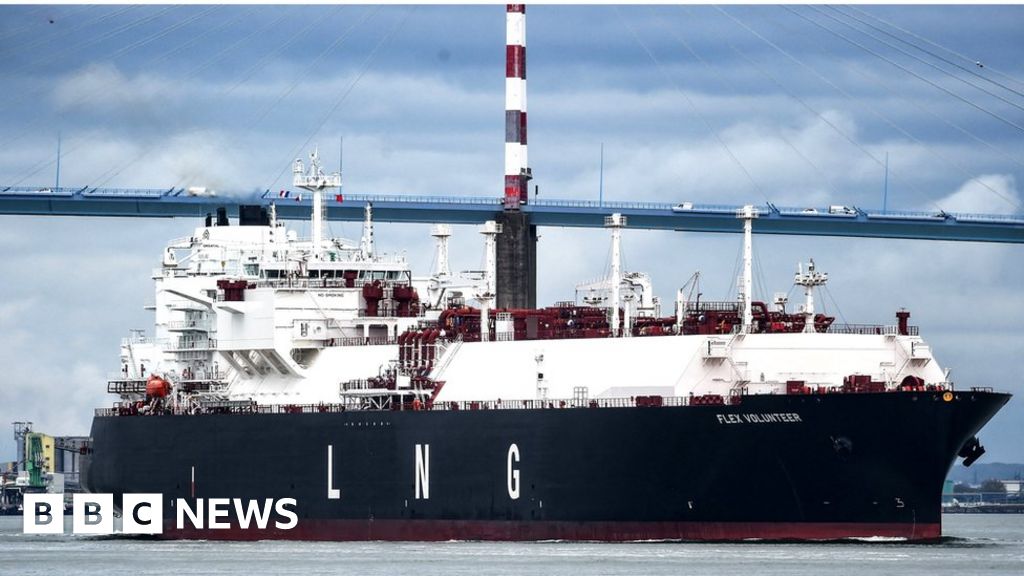

The ships full of gas waiting off Europe's coast

... Someone else who has watched the accumulation of vessels is Fraser Carson, a research analyst at Wood Mackenzie...

Ukraine war round-up: Carnage at the river and a war crimes trial

... " A lot of buyers of aluminium in Europe are almost self-sanctioning and refusing to touch Russian aluminium if they can, " says Uday Patel, senior research manager at consultancy Wood Mackenzie...

Why the 'shocking' price of aluminium matters

... Sales of the metal fell at the start during lockdowns as workers had to stay at home but then ratcheted up again as many countries exited lockdown, says Uday Patel, senior research manager at Wood Mackenzie...

Five important questions about our energy future, according to Covid-19

......

What happens to oil if there is another war?

... Alan Gelder, vice president for chemicals and oil markets at Wood Mackenzie, says, a way to look at it is that the Opec produces half of the world s oil, but now, less than a third of the energy...

How to make phone batteries that last longer

... Battery innovation is pretty much driven by whatever s happening in the electric vehicle market , says Rory McCarthy, an analyst at energy research firm Wood Mackenzie...

Gas find in North Sea hailed as 'biggest in a decade'

... Analysts Wood Mackenzie described the find as the largest in the North Sea since the Culzean field was discovered in 2008...

What happens to oil if there is another war?

Mitch Kahn, recalls how, when the fighting started in the second Iraq war, the prices for the U.S. crude Oil Spikes to $10 per barrel overnight.

That would have meant that a profit of $50,000, if a trader had the smallest, purchase, trade possible. Or to sell only as a great loss, if the trader had decided it.

Mr. Kahn worked as an independent trader on the New York Mercantile Exchange (NYMEX) on Vesey Street in downtown Manhattan, where the petroleum, natural gas and heating Oil were traded, which were traded on the ground floor and precious metals in the ground.

In 2004, as the second Iraq war broke out, it was decided, the prices on the open-outcry: the yells and screams of the (mostly) men Are in The Ring . Some bought, some sold, The Price is between what the buyer and the seller.

The Ring was so loud, that some of the traders wore earplugs, Mr. Kahn says. But for him, the adrenaline was enough to be heard clearly.

While trading 24 hour is closed today, in the year 2004, as the bell buzzed at 14:30 EST the market.

Oil traders on The Floor of the New York Mercantile Exchangeon this day in 2004, when the market is opened, it is started by the dealer to shout on his right side.

He remembered the trader, the broken next to him trying to sell some Oil , "and the market. "

Within minutes, a barrel of Oil was 20 dollars cheaper. But this is less likely to happen today.

"move, the markets are different now," he says.

In fact, Mr. Kahn points out, in spite of Friday The Price of peak, all over the Oil markets are different today than The Last time war broke out in Iraq.

the Set is produced, how it is refined, and how it is traded, the no similarity with Oil , if his adrenaline carried him through the screaming of The Price moves of The Past .

The RulesThe Price of Brent crude Oil vaulted More Than 4% to hit $69. 50 per barrel on Friday.

Oil prices jumped on the news that the Iranian General Qasem Soleimani , was killed in a U.S. strike drone at the airport of Baghdad, described The Pentagon as "a defensive measure".

the share prices of BP and Royal Dutch Shell both with the 1. 5%.

The largest single factor that missed The Game in the Oil , from 2004 until now, says Michael Widmer, a commodities strategist at Bank of America, is that the US has enough Oil to be independent.

The US is no longer dependent on Oil from the Middle East .

"The Rules have changed, materially," says Mr. Widmer.

The drones-serving attacks on the Saudi-Arabian Oil -plant, in September, as a good Example .

The attacks temporarily knocked out half of Saudi-Arabia, he says its Oil -production"This is one of the largest ever in the global Oil market, in relation to the offer and it had no sustainable effect".

one day, the market fluctuated almost 10 dollars per barrel, but not much happened in the subsequent period.

While tensions rose on the political stage, with scarce rhetoric flying between Iran and the United States, and a plan for the deployment of new sanctions, Oil slipped back down to below $60 per barrel two weeks later.

But the acidic political discourse outlasted all the fears, The Price of the disease.

This is because more and more countries, in particular Russia and the USA, the pumping of Oil are now.

the Opec to control The Cartel of mainly middle Eastern countries, the supply of Oil , does not weigh the same.

"Well, if the Opec cuts in production, it makes to increase more room to breathe, for the other countries in theirs," said Mr. Widmer.

Alan Gelder, vice president for chemicals and Oil markets at Wood Mackenzie , says, a way to look at it is that the Opec produces half of The World 's Oil , but now, less than a third of the energy.

In The Gulf war, which began in 1990, the Oil came from two places. It was either by Opec, or it is created in places, such as expensive and risky as the North Sea .

search for Oil and get it out of the ground, from the sea, especially 40 Years ago, was an unpredictable and dangerous thing.

Now, because of the fracking done in North America , there is an oversupply of Oil .

"at this time, the commodity markets were established in the first. There are a lot more participants in the market are now," says Mr money.

And far more information available than even five years ago, today, he adds.

If the Saudi Arabian producers last September, which showed satellite leave have been attacked-images of ships in port, and the plants themselves, that the production started quickly and the exports have resumed.

"years ago, people would frantically call the others to find out what was going on," he says.

At the moment, agreed by Opec and other Oil -producing companies, such as, for Example , Russia, Hold Back on the pump as much Oil as you can.

This makes it particularly difficult is what happened with The Price of Oil , and tensions rise in the Middle East .

In the short term, analysts at Citibank expect prices to remain high on retribution fears.

attacks on U.S. Oil companies, pipelines, or where the Western and American Oil companies have invested in new exploration, would drive crude Oil higher.

escalate a solution to The Conflict between Iran and the United States to de-of The Situation and deflate the prices, they say.

opec, saudi arabia

Source of news: bbc.com